Ticketmaster takes heat from senators, witnesses over its power

Ticketmaster defended its online market power in the digital ticketing space at a packed — and unusually unified — Senate Judiciary hearing Tuesday, after months of increased scrutiny following a chaotic sale of tickets to Taylor Swift’s upcoming tour.

The company has long been a target of lawmakers after its 2010 merger with Live Nation, but sparks started to fly after the messy rollout and ultimate cancellation of the public sale to the pop star’s nationwide tour.

The hearing kicked off the committee’s activity for the year with rare bipartisan unity — and may offer hope for lawmakers looking to revamp antitrust law.

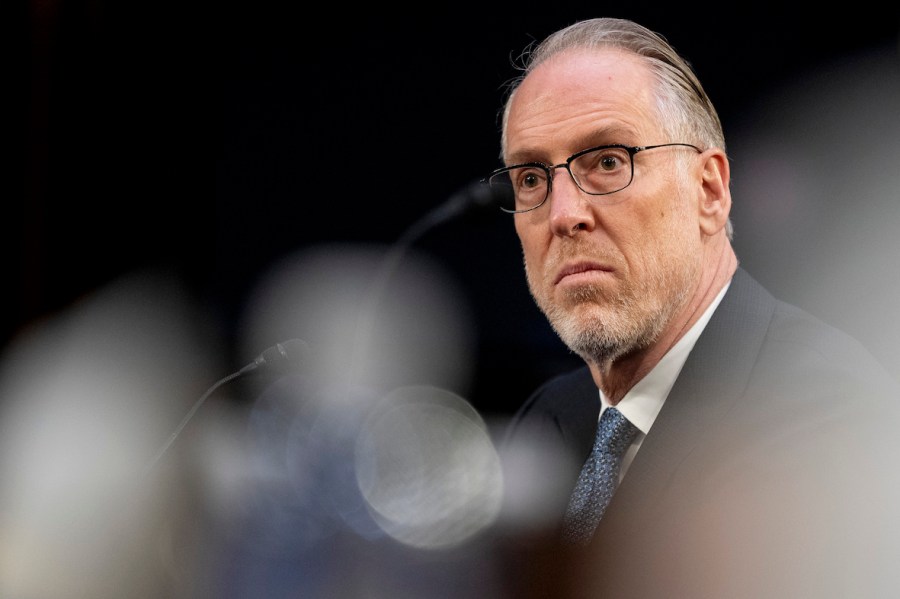

Senators on both sides of the aisle grilled Live Nation Entertainment’s president and chief financial officer, Joe Berchtold, over the company’s claim that there is more competition today than 13 years ago and that bots were to blame for the debacle.

“May I suggest, respectfully, Ticketmaster ought to look in the mirror and say, ‘I’m the problem, it’s me,’ ” Sen. Richard Blumenthal (D-Conn.) said, quoting recent Swift lyrics.

Here are 5 takeaways from the hearing.

Ticketmaster faces bipartisan wrath

Multiple Democrats suggested that the company should be broken up. Republicans didn’t go as far, but several labeled Ticketmaster a monopoly.

“Mr. Berchtold, I want to congratulate and thank you for an absolutely stunning achievement: You have brought together Republicans and Democrats in an absolutely unified cause,” Blumenthal told the ticketing executive.

The bipartisan tone of the hearing boosts the odds that Congress will push for legislation aimed at Ticketmaster, which controls roughly 70 percent of the ticketing market, including 80 percent of shows at major concert venues. Senators aren’t happy with Live Nation Entertainment’s structure that also gives it control over promotion. They accused the company of threatening to take shows away from concert venues that don’t choose Ticketmaster in an effort to undercut competition.

“Consolidation and power in the hands of the few can create problems for the many,” said Sen. Lindsey Graham (R-S.C.), the committee’s ranking member.

Ticketmaster apologizes, casts blame for Taylor Swift debacle

Ticketmaster’s defense of how it handled the sale for Swift’s “The Eras Tour” boiled down to blaming bot attacks for slowing down, and ultimately pausing, the sale of tickets.

Berchtold said Ticketmaster “planned accordingly” for the expected bot attacks for the presale, but the service was hit with “three times the amount of bot traffic than we had ever experienced.” For the first time in 400 sales using Ticketmaster’s “Verified Fan” process, the bots came after the access code servers.

“We apologize to the fans, we apologize to Ms. Swift. We need to do better, and we will do better,” Berchtold said.

Jerry Mickelson, CEO of the independent live entertainment company Jam Productions, testified at Tuesday’s hearing that it is “pretty unbelievable” for the leading ticketing company to not be able to handle bots.

“You can’t blame bots for what happened to Taylor Swift. There’s more to that story you’re not hearing,” he said.

Mickelson added that when the process for buying tickets is slowed down, it drives up prices, and fees, to the advantage of Ticketmaster.

Market dominance impacts artists, consumers

Using Swift-inspired lyrical references, senators and the witnesses broadly pointed out that the situation highlighted by the Swift ticket sale is emblematic of a broader equity problem that they see in the market.

“Whether it’s the consumer, the artist, the production manager, this is an issue of fairness. And right now, we have a system that is not fair,” Sen. Marsha Blackburn (R-Tenn.) said.

Clyde Lawrence, a singer and songwriter for the band Lawrence, said part of the issue is that Live Nation Entertainment essentially serves three roles: promoter, venue and ticketing company. When it comes to certain facilities fees to put on an event, as the exclusive promoter and owner or operator of a venue, Live Nation essentially winds up “negotiating to pay itself.”

“Due to Live Nation’s control across the industry, we have practically no say or leverage in discussing these line items, nor are we afforded much transparency surrounding them,” Lawrence said.

Through the three roles Live Nation plays, an artist could end up with $6 from a ticket sold to a fan for $42, he said.

The combination of roles that Live Nation and Ticketmaster play as one company gives them a different business model from independent promoters, Mickelson said.

“We have to make money by putting on concerts; they don’t, because they make more money from ticketing and sponsorships than they do from concerts. And concerts [are] basically a loss leader for them to bring more talent and more content to the arenas they are servicing to get the ticketing contracts,” he said.

Senators eye violations of merger agreement

The Department of Justice (DOJ) approved the Live Nation-Ticketmaster merger in 2010 but made the companies sign a consent decree promising they wouldn’t retaliate against venues that didn’t use Ticketmaster for ticketing.

Nearly a decade after the decree was signed, the DOJ found repeated violations, alleging that venues “have come to expect that refusing to contract with Ticketmaster will result in the venue receiving fewer Live Nation concerts or none at all.”

Instead of taking the company to court, the DOJ in 2020 strengthened the terms and extended the decree five years.

Senators on Tuesday expressed frustration that both the original decree and the modified version weren’t effective. Some said the merger should be undone if the DOJ established continued violations.

“Here we are, almost 13 years later, faced with a flotilla of allegations and complaints that the merged entity has done exactly what it said would never happen,” Sen. Mike Lee (R-Utah) said.

Ticketmaster drama could prompt new laws

Witnesses and senators said new antitrust laws would make it easier for the DOJ to sue companies engaged in vertical mergers, which involve complementary services within the same industry.

“It’s hard, given the current state of the law, for DOJ to pursue a vertical merger case. So that will make them, in many cases, hesitant to do that,” said Kathleen Bradish, vice president for legal advocacy at the American Antitrust Institute.

With new laws on vertical mergers in place, Bradish said, the DOJ would be empowered to sue Ticketmaster rather than continue to settle with the company.

Sen. Amy Klobuchar (D-Minn.), a proponent of stronger antitrust laws, has proposed legislation to boost revenue for antitrust enforcers and help block anticompetitive mergers.

Democratic senators also called for more transparency in ticket pricing, expressing support for the BOSS Act, which would require ticket sellers to disclose fees up front.

Berchtold said that the BOTS Act, a 2016 law that aims to punish scalpers for using bots to buy tickets, should allow companies to bring lawsuits against the scalpers, noting the Federal Trade Commission rarely enforces the law.

Senators discussed — and largely dismissed — the idea of restricting consumers from transferring tickets as a way to stop scalpers from driving up prices, another policy that Ticketmaster supports.

“It seems to me that impairing transferability might also harm competition, and therefore consumers, by preventing legitimate secondary ticketing companies from gaining any traction,” Lee said.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts