On The Money — Lawmakers closer to government funding deal

Happy Wednesday and welcome to On The Money, your nightly guide to everything affecting your bills, bank account and bottom line. Subscribe here: digital-stage.thehill.com/newsletter-signup.

Today’s Big Deal: House and Senate negotiators are closing in on a long-term government funding deal. We’ll also look at a big advancement for a proposed congressional stock trading ban and Democratic calls to suspend the gas tax.

But first, find out how former President Trump’s trade adviser ended up in the bad graces of the Jan. 6th committee.

For The Hill, we’re Sylvan Lane, Aris Folley and Karl Evers-Hillstrom. Reach us at slane@digital-stage.thehill.com or @SylvanLane, afolley@digital-stage.thehill.com or @ArisFolley and kevers@digital-stage.thehill.com or @KarlMEvers.

Let’s get to it.

Negotiators reach ‘breakthrough’ on funding

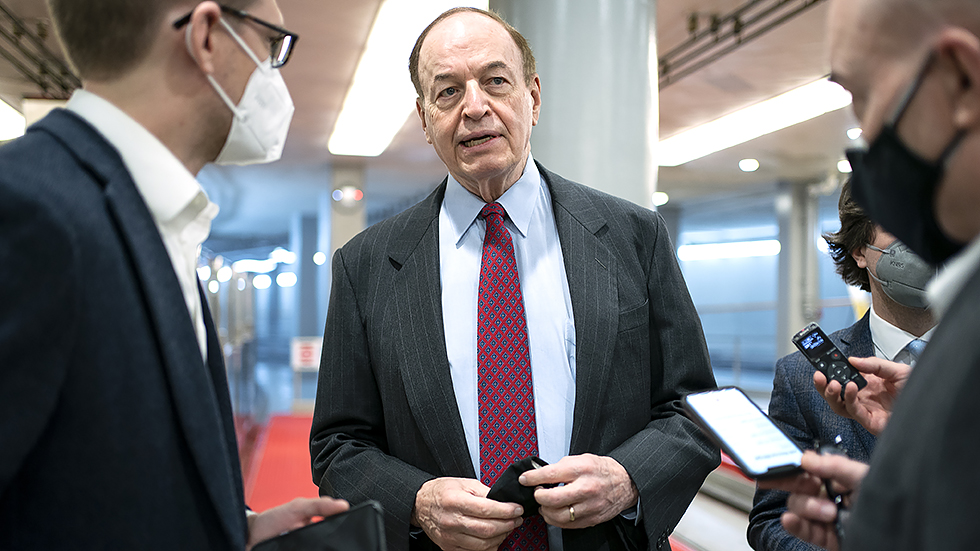

Sen. Richard Shelby (Ala.), the senior Republican on the Senate Appropriations Committee, announced Wednesday that negotiators have reached a “breakthrough” agreement on the framework for an omnibus spending package he predicts will help the two sides agree to the spending top lines very soon.

He said the top-line spending numbers for defense and nondefense discretionary programs, which have been a major sticking point in the talks, “will come from that” framework.

“We have reached an agreement on framework,” Shelby told The Hill shortly before noon, calling the development “big.”

The background:

- Funding for the federal government lapses Feb. 18, though the House on Tuesday passed a short-term extension that would stave off a shutdown through March 11.

- House and Senate negotiators have spent weeks trying to strike a longer-term funding deal for fiscal 2022 and take a potential shutdown ahead of the midterm elections off the table.

The caveat: Shelby declined to go into more detail or comment specifically on whether the disagreement between Democratic and Republican negotiators over policy riders had been resolved. He also didn’t mention if negotiators had agreed on the thorny question of how much to increase funding for non-defense discretionary programs compared to defense programs. So there’s still a bit of work to do.

Alexander Bolton has more here.

MORE MOMENTUM

Pelosi backs ban on stock trading in Congress

Speaker Nancy Pelosi (D-Calif.) has directed House Democrats to draft a bill to ban members of Congress and their senior staffers from trading individual stocks, giving the push newfound momentum.

Democratic leaders reportedly aim to vote on a stock trading bill by the end of the year, potentially before November’s midterm elections.

During a press conference Wednesday, Pelosi said lawmakers are looking to find consensus on “government wide” stock trading reforms that also cover the judiciary, including Supreme Court justices, who aren’t required to disclose financial transactions.

- That’s a reversal for Pelosi, who came under fire in December for pushing back on efforts to rein in lawmakers’ ability to trade stocks.

- Senate Majority Leader Charles Schumer (D-N.Y.) also got behind a congressional stock trading ban this week, further bolstering its chances.

- Senate Minority Leader Mitch McConnell (R-Ky.) told reporters he would also consider supporting a ban, noting he doesn’t trade individual stocks.

It’s unclear just how Democratic leaders want to end the practice. Several bipartisan bills that have already been introduced in the House and Senate require lawmakers to either divest from their assets or put them in a blind trust. Some proposed bans apply to lawmakers’ spouses, while others impact their senior staffers.

Karl has more here.

TRADEMARK TUSSLE

US-China competitiveness bill sparks battle over e-commerce

Etsy, eBay and other e-commerce firms are lobbying lawmakers to strip an anti-counterfeit measure out of the House-passed bill to bolster U.S. competitiveness with China, warning that it would force most online marketplaces to shut down, leaving only a few industry giants like Amazon to dominate.

The Shop Safe Act would open up online marketplaces to lawsuits over the sale of counterfeit goods if they don’t comply with new regulations requiring them to identify and remove knockoff products from their site. Opponents argue that the vast majority of digital marketplaces don’t have the resources to comply with the new requirements.

- Online platforms that don’t comply with the rules would be liable every time they allow the sale of a counterfeit product that poses a risk to consumer health and safety.

- Clothing, cosmetics and toy brands are among those lobbying for the measure, arguing that it would stunt the recent growth in illicit trade that threatens consumers and U.S. companies.

- E-commerce firms and internet privacy groups argue that the bill’s provisions are far too broad and could open up NextDoor, Twitter or even email providers to lawsuits over products sold on their platforms.

Karl has more here.

PUMP THE BRAKES

Vulnerable Democrats call for gas tax suspension amid rising prices

Democratic Sens. Mark Kelly (Ariz.) and Maggie Hassan (N.H.) are calling for the federal tax on gasoline to be suspended until next year amid rising prices.

Hassan and Kelly, both of whom are facing reelection in swing states in November, introduced legislation on Wednesday that would wipe out the approximately 18-cents-per-gallon tax on the fuel until the start of 2023.

The proposal was co-sponsored by Sens. Raphael Warnock (D-Ga.) and Catherine Cortez Masto (D-Nev.), who also face tough reelection fights this year, as well as Sens. Debbie Stabenow (D-Mich.) and Jacky Rosen (D-Nev.).

- Gasoline is made from oil, which is a global commodity, meaning prices are not just affected by domestic factors, but also by actions of countries abroad.

- But gasoline prices, in addition to general inflation, are an area that Republicans have been consistently trying to pin responsibility for on their Democratic counterparts ahead of the midterms.

Rachel Frazin has more here.

Good to Know

University of Michigan provost and economics professor Susan Collins was announced Wednesday as the next president and CEO of the Federal Reserve Bank of Boston.

Collins, an economist who studied at Harvard University and the Massachusetts Institute of Technology, will become the first woman of color to lead one of the Fed’s 12 regional reserve banks. Read more here.

Here’s what else we have our eye on:

- The Washington Nationals announced a cryptocurrency partnership that could allow fans to pay for tickets and concessions with digital tokens as soon as next year.

- Microsoft announced new rules for its app stores on Wednesday, as regulators consider the company’s plans to acquire gaming company Activision Blizzard.

- The private contractor ID.me is dropping the facial recognition requirement from its identity verification software that is widely used by state and federal agencies.

- The IRS’s taxpayer advocate warned that millions of taxpayers could see delays in their tax returns being processed due to an accumulation of unprocessed returns from last year.

- The Biden administration on Wednesday pushed back on what it called “misinformation,” saying a federal grant program meant to reduce harm to drug users does not include taxpayer funding for pipes that can be used to smoke crack or meth.

That’s it for today. Thanks for reading and check out The Hill’s Finance page for the latest news and coverage. We’ll see you tomorrow.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts

Video/Hill.TV