US needs a strategy for minerals competition: It’s not just rare earths

When the Polish president came to Washington, D.C., one mild June day, his host treated him to a rare spectacle: an F-35 soaring with a decidedly unstealthy roar over the White House. Ironically, just a few days earlier, “60 Minutes” reported that the combat aircraft basically flies by the grace of China. According to the report, a single F-35 contains about half a ton of rare earth elements (REEs), a class of minerals almost exclusively mined and processed in China today.

With the United States government officially labeling China a great power competitor, this dependence seems problematic, especially as the Chinese have suggested they may curtail REE exports in response to Trump administration tariffs. This is no empty threat: In 2010, China cut its exports of rare earth elements by around 40 percent, touching off a trade dispute with the United States, Japan and more than a dozen other countries. Ultimately, the World Trade Organization issued a finding against China, which grudgingly ended its quotas.

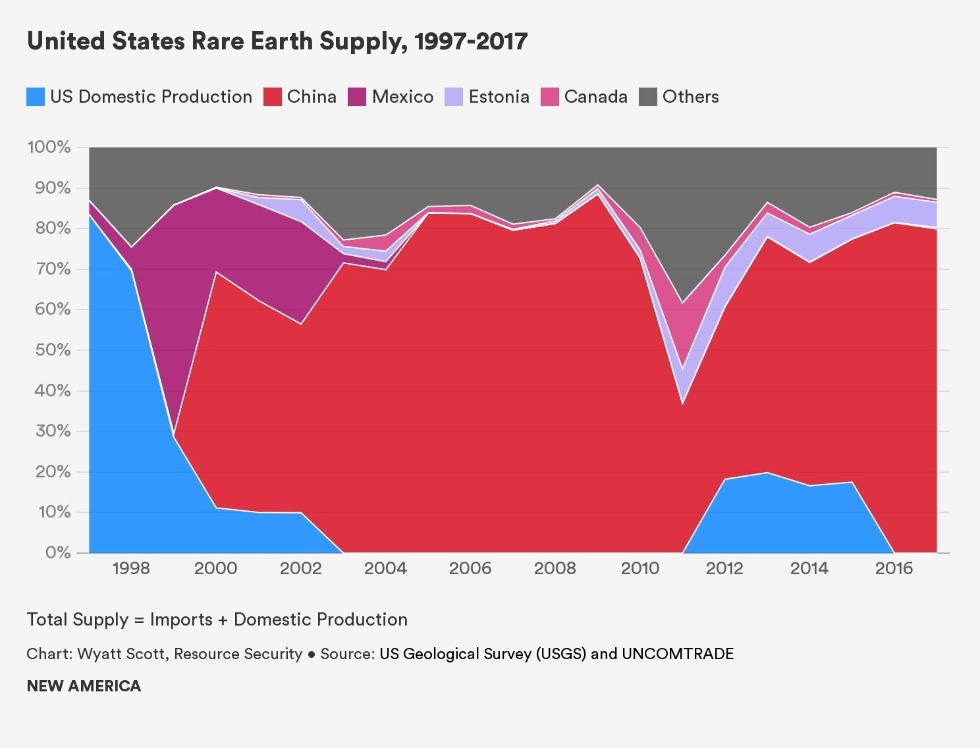

Even though global markets actually started to compensate with new production elsewhere at the time, concern about REEs has never abated in Washington, and is, in fact, picking up speed once again. Even so, the United States has remained highly dependent on China for REEs, even as these materials have become more important for military and consumer technologies and the clean energy transition.

Although REEs capture the headlines — partly because China dominates not only U.S. consumption but also accounts for about 70 percent of global production and almost all refining operations of the raw ore — the United States relies on imports for a whole range of minerals and metals.

China, for example, supplies the majority of the U.S. arsenic metal and a significant amount of U.S. gallium imports. High purity arsenic is necessary to create GaAs (gallium-arsenide) integrated circuits, which are integral in many defense-related applications; there is no effective substitute for GaAs in these applications.

Germanium is another prominent example. Germanium is an input in mid-and-long-wavelength infrared (IR) lenses used in military night vision goggles and thermal scopes. But these lenses also have applicability in civilian technologies, including cameras for intelligence collection and capturing footage at night, scanning produce and other imports thoroughly to detect, among other defects, biochemical agents, as well as medical imaging for diagnostic purposes. Substitutes for germanium in these IR applications do exist, but generally with degraded performance.

On the other hand, U.S. dependency on mineral imports is not necessarily a vulnerability. In fact, a functioning free market in these materials has been a comparative advantage for the United States, one that has helped spur both innovation and the availability of relatively low-cost technology, from munitions to smartphones to medical equipment.

In an era of great power competition, however, a lopsided dependence on China and lack of diversification to other producers has the potential to be an economic and geopolitical weakness, depending on what China decides to do.

If global demand for these materials increases, China could well take steps that further undermine global markets. That’s not even necessarily a sinister plot; China will understandably put its own economy first.

The Trump administration recently released a new strategy for addressing this vulnerability, a step in the right direction.

At the same time, one of the reasons China dominates the global market for REEs and other minerals is their willingness to mine and refine ores at any cost, including to human health and safety. U.S. government subsidies to bolster strategic metals in the 1950s ultimately brought more costs than benefits, and the single rare earths mine in the United States is still struggling with the legacy of a massive toxic spill in the 1990s.

The United States should have a strategy that includes sensible regulatory reform, smart global investments and partnerships, new ways of refining, and even the sort of minerals recycling the Department of Defense is already doing, all while preserving the country’s commitment to competitiveness, the environment, and safety.

In other words, when it comes to strategic and critical minerals, great power competition should not become an excuse to race to the bottom.

Sharon E. Burke is a senior adviser at New America; previously she served as assistant secretary of Defense for Operational Energy from 2010-2014. Follow her on Twitter @burkese and @PhaseZeroNA. Wyatt Scott is a research assistant with New America’s resource security department.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts