Interest-only loan growth: A harbinger for recession?

Interest-only loans are on the rise, which has some analysts spooked that the economy is already trending toward a recession. If only it were that easy to foretell economic contraction.

Our firm, Trepp, recently published research highlighting the trend of interest-only loans gaining market share in commercial real estate (CRE) securitized loan pools. Undoubtedly, this is a segment of the market to monitor, and we do all kinds of analysis to help investors assess risk and assign value to commercial real estate loans and bonds.

{mosads}Some are making parallels to 2007 and the subprime mortgage crisis — the last time we saw a dramatic rise in interest-only loans — and crying “wolf.” During the recession, interest-only loans were hit harder by delinquencies and were more susceptible to losses as property prices cratered.

We are currently seeing a similar increase in interest-only issuance. Today, however, A plus B does not necessarily equal C.

When the economy is humming, interest-only loans become a bigger portion of overall issuance. Borrowers who take out interest-only loans pay interest alone instead of principal and interest for either the full term or a portion of the loan’s life.

At the same interest rate, these loan payments are lower than an amortizing (principal and interest) loan. This means the same amount of income can cover the payments on a larger loan if it is interest-only. It is effectively another form of leverage for the borrower.

For the commercial real estate investor and developer, the interest-only loan frees up cash during the interest-only period, which is common in certain types of financing, like construction loans, bridge loans, some agency (Freddie Mac and Freddie) loans and commercial mortgage backed securities (CMBS). This type of financing enables investors to make acquisitions, expand or reinvest in the business.

Because the principal balance remains static in an interest-only loan, no natural deleveraging occurs during the life of the loan unless the value of the property increases. All else equal, interest-only loans are riskier than amortizing loans. Despite this, the bad reputation of these loans is unwarranted in today’s market.

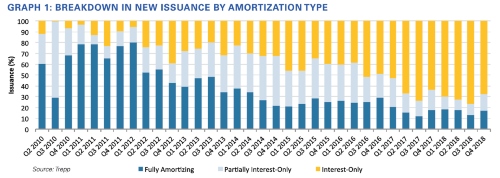

Over the last several quarters of new origination in CMBS, full or partial interest-only loans made up a little over 80 percent of new loan balance. During the first few years post-recession, when underwriting was as tough as ever and investor risk appetite was still recovering, the level was closer to 50 percent.

This increase is less an indicator of the riskiness of the underlying loans and more of a consequence of the strong economy and liquid capital markets. More and more capital is flowing into the CRE finance world from banks, insurance companies, agencies and other alternative lenders.

This means classic CMBS lenders face stiffer competition when making new loans and one way of incentivizing borrowers is to offer interest-only loans.

Despite the increase in interest-only loans, underwriting is strong relative to the pre-crisis era. Two common measures of riskiness in this market are debt service coverage ratio (DSCR) and loan to value (LTV). By both measures, recently originated loans have a lot more room for error than did pre-crisis era financing.

In 2007, average DSCRs were in the 1.25x range, meaning that for every $1 a borrower owed in principal and interest payments, the property was generating $1.25. This meant that it would take a 20-percent drop in income before the borrower had to pay out of pocket or default on the loan.

These days, the average DSCR on new interest-only loans is in the range of 1.6x. Loan-to-value averages, the ratio that describes the size of the loan compared to the value of the property, are also significantly healthier than pre-crisis deals.

This means borrowers have more skin in the game and lenders have more room for error if property prices decrease. So, despite the surge in interest-only issuance, today’s interest-only loans are safer than the ones that were coming out in the go-go days when too much borrowing resulted in risky, easy money.

{mossecondads}Certainly, interest-only loans can be a canary in the coal mine as other economic factors start to deteriorate. During the last recession, there were a lot of other trends that allowed more leverage to the borrower: high valuations that were not sustainable; more mezzanine debt on properties; and aggressive underwriting tactics.

In terms of the broader markets, right now we see decent wage growth, low unemployment, tepid inflation, continued low interest rates and stock market records. Interest-only loan growth is not an issue in and of itself, but it may point to the fact that the market is at or near a peak again.

Usually, markets are overly focused on what happened to cause the last recession. While we all look in the rearview mirror, the next downturn often stems from something few see coming. In the meantime, we will keep our eyes peeled for other possible cracks in the economic armor.

Joseph McBride is the director of research and applied data at Trepp, LLC, which provides analytics and technology solutions to CMBS, CRE and banking markets worldwide.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts