Meet the new slow-and-steady American consumer

When the Commerce Department reported 3.2 percent annualized U.S. GDP growth for the first quarter in late April, it caught pundits, academics and economists by surprise.

January’s record government shutdown, the fourth-quarter plunge in stock prices and widely-reported recession fears had dragged down consensus estimates, which hovered closer to 2.2 percent.

{mosads}The report seemed to confirm the strong stock market gains of the first quarter, particularly when considered against the recession fears that dominated the final months of 2018.

However, hiding behind that strong GDP number was the second-weakest quarter for consumer spending in three-and-a-half years, a performance made worse when considering the dreadful 1.6 percent decline in December retail sales.

Fluctuations in trade and government spending, combined with a build-up in business inventories, accounted for 2.0 percentage points of the 3.2-percent gain.

Given the importance of consumers to the American economy, should the first-quarter weakness be perceived as a sign of more troubling economic conditions ahead? No, not in our opinion.

If consumers were in poor financial shape, as they usually are this deep into an economic expansion, we would be much more concerned with the first-quarter results. However, we’re dealing with a new American consumer.

Gone are the materialistic days of the 1980s, the internet mania and “Dow 36,000” ideas of the late 1990s or even the riches through real estate philosophies of the housing bubble.

Importantly, while consumer spending slowed in the first quarter, consumer income growth remained solid. As a result, the savings rate over the first three months of the year was a healthy 7.0 percent. Put differently, consumers were not out of spending fuel, they were simply keeping it in reserve.

The new American consumer: Slow and steady

Since the Great Recession ended in mid-2009, consumers have been more conservative in their spending behavior and finances than they have been in decades. Nowhere is this more evident than in looking at consumer debt relative to income.

Historically, as the economy expands, so does consumer leverage (debt relative to income). Eventually, debt burdens become stretched, forcing households to slow their spending. Businesses would react by shedding workers and pulling back on their own spending — and the next recession would be born.

Not this time around

While consumer confidence has risen steadily throughout the current expansion, consumer debt relative to income has not. The Federal Reserve’s Financial Obligations Ratio (FOR) looks at required consumer monthly payments in relation to disposable income.

Through the fourth quarter of 2018, although the ratio is off its post-recession lows, it remains at levels not seen since the early 1980s — a time when excessively high interest rates made borrowing money akin to sticking one’s hand into an open flame.

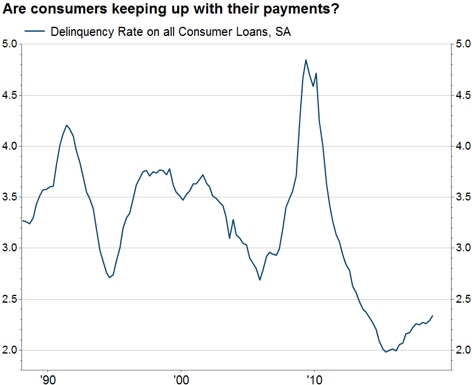

Additionally, consumer loan delinquency rates, though off their record lows of a few short years ago, remain well below their all-time lows as seen prior to the Great Recession. It’s even become fashionable to have a high credit score.

As the consumer goes, so goes the economy

Consumers account for 70 percent of U.S. economic activity, and no sector comes close to its influence over the direction of economic activity. Quarterly results fluctuate, but over time as the consumer goes, so goes the U.S. economy.

Of course, consumers can be fickle, or cautious, as we prefer to describe their first-quarter spending behavior. Yet, sound finances provide a solid base to the economic outlook, in our view.

We do not expect spending to surge by any means, at least not on a sustained basis, but neither do we see reason for consumers to materially constrain their spending any time soon.

Slow and steady wins the race

Since the Great Recession ended in mid-2009, the U.S. economy has registered an average annual real growth rate of 2.3 percent, which is slower than historical averages but very close to what we believe is the U.S. economy’s current sustainable pace of between 2.0 percent and 2.5 percent.

As the term implies, this is the rate the U.S. economy can theoretically sustain given its underlying demographics and assumptions about productivity (the Congressional Budget Office uses the term “potential” rate of growth).

For example, over the last 10 years, growth has been slower than historical averages, yet strong enough to achieve a steady decline in unemployment and generally balanced inflation, all the while not needing to rely on a buildup in leverage (i.e., debt).

The economy’s sustainable rate may ease a bit more in the years and decades ahead, but longer expansions, contained inflation pressures and lower interest rates (than historical averages) is a favorable trade off in our view.

The late-cycle misnomer

The U.S. economy is in its 10th year of expansion, well beyond the historical average of seven to eight years. As a result, the term, “late cycle” has become quite fashionable in the investment world. But investors should take such terminology with a grain of salt.

{mossecondads}Economic downturns do not come and go based on the calendar. They come and go when imbalances build up in the economy, usually in the form of too much consumer debt.

Additionally, the good news on consumers does not end with sound balance sheets. As is well known:

- the job market is stronger than it has been in decades;

- home values are well supported by fundamentals;

- wage growth is gaining traction albeit at a reasonable pace; and

- true inflation problems are little more than a textbook topic to anyone born after 1980.

As with nearly everything in life, no one can predict the future, economic or otherwise, with guaranteed accuracy. However, in our view, there is no better way to increase your odds of a positive economic outcome than to step into that future with sound consumer finances.

Russell Price is the chief economist for Ameriprise Financial.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts