The labor force brings some joy to the ‘dismal science’

Economics is seldom lacking in bad news; it is the “dismal science” after all. But sometimes economists are pleasantly surprised. In fact we are in midst of an ongoing positive surprise in the U.S. right now: the strength of the labor force participation rate.

Four years ago, the conventional wisdom among economists was that few of the working-age adults who left the labor force in the wake of the Great Recession would return.

{mosads}Coupled with retiring baby boomers, the implication was that the overall labor force participation rate — the share of adults with or actively looking for a job — was doomed to keep falling.

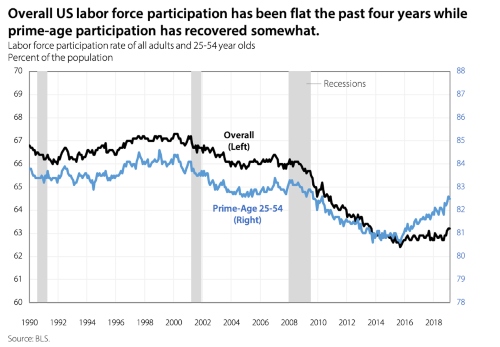

But these forecasts were wrong. Instead of falling, the overall participation rate has stayed roughly flat, which is a surprisingly positive outcome against the backdrop of the aging population. And the prime-age (25-54) participation rate has risen 1.5 percentage points since 2014.

It turns out that the tightening labor market of the last several years worked wonders. In particular, as jobs became more plentiful and wages gradually firmed, prime-age Americans who were out of the labor force due to disability or ill health or who wanted a job but had gotten discouraged and gave up looking started coming back after 2014.

Those two categories of workers were enough to fully offset the downward effect on participation from an aging population. And while both men and women have seen labor-force gains since 2014, women have returned at about twice the magnitude of men.

The lesson of the last four years, then, is that the declines in participation we saw in the wake of the Great Recession were less permanent than many economists thought. Without another recession, there’s even good reason to think prime-age participation has some further room to grow.

But another recession some day is inevitable, and when — not if — it hits, U.S. participation will likely fall again without changes to our labor market policies and institutions.

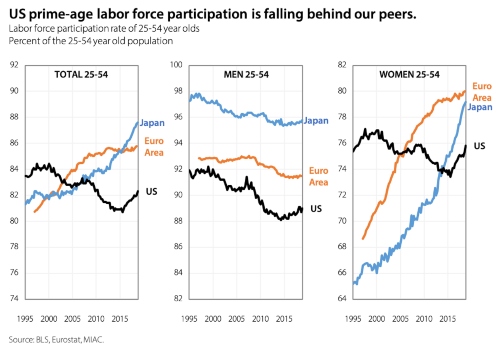

This reaction isn’t inevitable; in fact, among advanced countries, U.S. labor force participation seems uniquely sensitive to recessions. Europe and Japan were hit hard by the Great Recessions, too — and Europe even endured another recession in 2012. Yet, both have managed striking gains in prime-age participation.

As a result, U.S. prime-age participation is falling further behind our peers, particularly among women, despite the fact that just 15 years ago the U.S. enjoyed an advantage in female employment.

So if we want the U.S. labor market to not only survive the next recession but also thrive in the long-term, then we need serious reforms. There are five buckets of policy changes we might make.

An underrated reform would be a strategic shift in how the Federal Reserve and fiscal policymakers approach the next recession and its recovery. A Fed that is more accommodative to a heating economy — for example by allowing inflation to make up for past shortfalls — would help participation recover faster and longer.

And while federal deficits and debt have long-term trade-offs that merit serious consideration, pivoting to austerity too quickly can slow down recoveries.

When long-term interest rates are falling and are below economic growth, as they’ve been recently, it can make sense to deficit-finance smart tax and spending policies to support the economy.

Labor supply policies would help boost participation in both good and bad times. The growing gap in women’s participation between the U.S. and other advanced economies is partially explained by stronger family-friendly policies elsewhere, such as child-care allowances and paid parental leave.

The U.S. tax system is also particularly punitive to spouses with paid work, which discourages labor-force attachment, as does the fact that many U.S. safety net programs and tax benefits taper off at relatively low levels of earnings.

Fixing these disincentives by, for example, making programs more universal would lower these barriers to the labor force. In the U.K., for example, the core disability benefit doesn’t fall if the recipient works, whereas in the U.S. both disability and supplemental benefits drop sharply or even disappear entirely after only modest wage earnings.

{mossecondads}Stronger countercyclical policies would help stave off the effects of future recessions. On the less ambitious end, but thoroughly proven around the world, are active labor market policies like job search assistance, job training and hiring subsidies.

The U.S. currently spends just one-fifth the Organization of Economic Cooperation and Development average on such programs, less than all other advanced economies besides Mexico.

Firming up traditional “automatic stabilizers” like unemployment insurance and food stamps and making them more compatible with job finding, would help ensure that workers aren’t forced to rely on other safety net programs like disability benefits when downturns are long and deep.

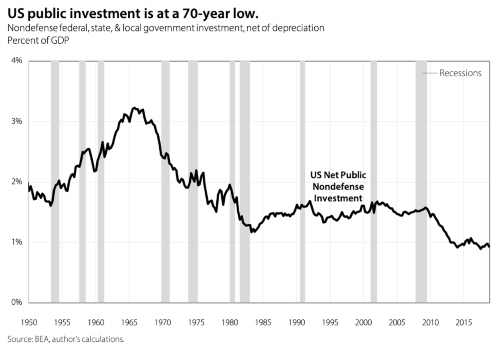

Public nondefense investment is also currently at a 70-year low in the U.S.; boosting this on a ongoing basis would not only help the economy weather recessions but also raise the quality of American infrastructure and increase our economic capacity.

Even bolder ideas, such as a large federal jobs corps or a jobs guarantee, are less tested and carry more risks but promise higher rewards; regional pilot programs would help us understand the breadth of challenges and benefits from these ideas.

Other policies may not boost the headline participation rate immediately but would strengthen the dynamism and competition of the labor market.

These include severing the link between health care and employment through universal health insurance, combating excessive occupational licensing and urban land use restrictions, limits on non-compete agreements and stronger antitrust enforcement.

Finally, distributional considerations are important. Place-based policies, for example, would steer investment to rural areas and blighted urban communities that have not fared as well as high-income metros in this recovery.

Another focus would be on workers who have traditionally shown weaker labor force attachment, such as the formerly incarcerated and Americans of color.

With thoughtful policy changes, the U.S. can build on the good news of the last four years and strengthen the labor market going forward so that the next recession doesn’t set us back as much as the last one.

Ernie Tedeschi is a policy economist and head of fiscal analysis at Evercore ISI, a macro advisory firm. He previously worked at the U.S. Department of the Treasury.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts