Government study will shed light on volatile capital markets

Always innovating, capital markets participants, both established and entrepreneurial, have again taken on outdated methods and structures promulgated by centuries-old institutions.

Precedents that have long supported the entrenched overseers and gatekeepers of the U.S. capital markets are being challenged. Long-brewing is the friction between exchanges and the investment bankers, securities firms, market makers and asset managers that encourage companies to list on these exchanges and then trade their listed securities through them.

{mosads}Exchanges have long seen their trading revenue decline due to the now-permitted internal crossing of customer orders by brokerage firms, thereby bypassing the exchanges. These brokerage firms are now planning a further assault on exchanges by starting their own exchange.

Established exchanges are fighting back. First by increasing trade listing fees. Then increasing prices for supplying data on stock quotes and prices for stocks executed on their exchanges, still the required public benchmark for executing trades.

The data is paid for as fees to exchanges by individual firms as well as consortiums of firms crossing trades internally. Then, devising faster data feeds; providing data for a deeper dive into standing orders left on the books of the exchange to be executed; and more direct access to exchange computers for high-speed trading, are all offered as additional fees to firms.

This later capability, referred to as “co-location” services, allows a firm’s computers to reside close to exchange computers to limit lag time to execute a trade. Competition for faster access compels firms to buy these new services and increases the costs for doing business with exchanges.

Exchanges have also promoted new methods of bringing firms’ public, directly listing on an exchange and cutting out the investment bankers’ fees. The first such direct listing was the landmark Spotify Technology S.A. listing on the New York Stock Exchange (NYSE) back in April, 2018. This is now being followed by a second such direct listing, that of Slack Technologies, Inc.

Now nine big Wall Street firms, the very organizations that bring listing to exchanges, trade through them and buy their data, unveiled plans to form a new national stock exchange called Members Exchange (MEMX).

The nine are Bank of America Merrill Lynch, E*TRADE Financial Corp., Morgan Stanley, TD Ameritrade Holding Corp., UBS AG, Virtu Financial Inc., Charles Schwab, Citadel Securities and Fidelity Investments. They are among the largest users of exchanges and pay the most for data from them.

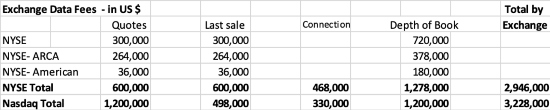

Sample costs for enterprise license for market data for selected exchanges

Note: Below costs do not include per unit fees for access to each of the above data services in the enterprise. These range from $12 -$840 annually for each terminal/individual having access.

Source: IEX Group, 2019.

The Committee on Capital Markets Regulation reported that the major U.S. exchanges earned $2.3 billion in 2017 from market data revenue, an increase of 45 percent since 2014. MEMX’s aim is to lower these and other trading costs by increasing competition, improving transparency, establishing basic order types, using the latest technology and offering a simple, low-cost fee structure.

In addition, MEMX will represent the interests of its founders’ and their collective client base of retail and institutional investors on the pending U.S. market structure review.

Market structure is an area of increasing concern as market volatility of late has unnerved investors. It has been associated with one of the reasons the Fed adjusted its thinking on interest rates hikes and led Treasury Secretary Steven Mnuchin to call for a market structure study.

Mnuchin blamed volatility in equity markets partly on high-speed trading and the effect of the Volcker Rule, the later a rule enacted after the financial crisis that increased the cost of trading.

Mnuchin is planning to conduct this review by asking the Financial Stability Oversight Council (FSOC), which he heads, to study stock market volatility. The FSOC was formed in the aftermath of the financial crisis and hosts the heads of all the federal agencies for banking, securities and derivatives.

It also includes a representative of the insurance industry, which is state-by-state regulated and has no federal agency overseeing it. In all, the FSOC has 15 members. It would be the first time that this group would oversee such a review. In the past, the Securities and Exchange Commission would have conducted this review.

That the U.S. capital market structure is completely dependent on smooth-running technology is a given. However, the technology that supports the essential parts of it, market data distribution, price discovery and trading, is quite fragile: Order placement, quoting and trading algorithms are vulnerable to coding errors and encountering transaction combinations not previously anticipated in the design of the software.

{mossecondads}High-speed networks that carry orders to and speed trades from exchanges, even though operating correctly, still permit a cascading of thousands of trades in milliseconds, sometimes overwhelming a trading venue’s capacity to handle the volume.

Hardware-created vulnerabilities are ever-present, experiencing periodic failures of arrays of storage and processing computers.

A market structure study is timely and should lead to uncovering some of the underlying issues driving market volatility. This would include:

- competition for listings and order flow;

- new order types and trade execution priorities;

- new order flow patterns form ETFs and retirement plans;

- participation by financial technology (FinTech) companies; and

- new approaches to replacing old, inefficient ways of conducting business in these completely digitized markets.

Involving all the financial agencies in this review through the FSOC should lead to insights into interconnectivity issues; regulatory gaps; technology vulnerabilities; and regulatory arbitrage.

Allan D. Grody is president of Financial InterGroup Advisors, a strategy, research and acquisition consultancy.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts