Argentina is running out of tools to lift its plunging currency

It would be a gross understatement to say that all is not well with the Argentine economy.

Despite a $50-billion support package from the International Monetary Fund (IMF), the Argentine peso is in freefall, inflation is accelerating and the economy is heading toward yet another deep recession.

This has to raise questions as to whether it will be Argentina rather than Turkey that is the first to impose exchange controls in response to their respective economic crises.

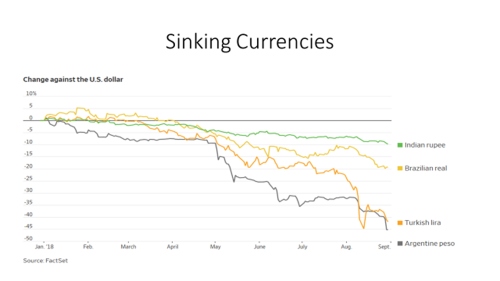

Since the middle of this year, nothing seems to have worked to stabilize the Argentine peso, which has lost almost half of its value since the start of the year, making its performance even worse than that of Turkey.

Hiking interest rates to a staggering 60 percent has not seemed to work. Burning international reserves to defend the currency has not worked. Calling in the IMF hasn’t done the trick either. Indeed, since a $15-billion IMF disbursement in June, the Argentine peso has managed to lose another quarter in value.

Argentina needs to stabilize its currency soon before a free-falling peso inflicts further damage to its fragile economy by stoking inflation, which is already running at more than 30 percent.

This would seem to be especially the case with likely spillovers to Argentina from a brewing currency crisis in Brazil ahead of that country’s contentious October presidential election.

It would also seem to be the case in the context of generalized emerging market currency weakness fueled by rising U.S. interest rates and a strengthening dollar.

However, Argentina seems to be running out of policy instruments to put a floor under its currency. Interest rates have been raised to their practical limit, the IMF has already been called in to little avail, and the country has only limited international reserves to use in defense of its currency.

Meanwhile, a clear move to greater fiscal discipline to restore investor confidence would seem to be a politically implausible option. Budget belt tightening will likely deepen the economic recession toward which the country now seems to be lurching.

Furthermore, the Macri government does not seem to have the political support for such belt-tightening, especially ahead of next year’s general election. Since having called in the IMF for assistance, President Macri has seen his support at the polls plummet from 50 percent to below 35 percent.

In December 2015, at the start of his presidency, the Macri government made the crucial mistake of lifting all exchange controls before stabilizing the Argentine economy and before aggressively embracing deep economic reforms.

It was like putting the cart before the horse in a country that is no stranger to currency and banking-sector crises.

The Macri government is paying dearly for that mistake. With the currency still in freefall and with other options having run out, President Macri cannot expect the IMF to pony up even more billions of dollars to finance massive capital flight from that country.

Rather, he may very well soon be forced to reintroduce exchange controls to put an end to the currency’s damaging free fall.

Deep as the Argentine economic and political crisis might be, Argentina would seem to be too small by itself to produce emerging market contagion. However, one would think that the reintroduction of Argentine capital controls would remind emerging market investors about the risks of investing in those markets.

Hopefully, Federal Reserve Chairman Jerome Powell is paying close attention to the unfolding economic crises in Argentina, Brazil, South Africa and Turkey. Maybe then the Federal Reserve will not get caught flat-footed in responding to an emerging market crisis that has the potential to derail the global economic recovery.

Desmond Lachman is a resident fellow at the American Enterprise Institute. He was formerly a deputy director in the International Monetary Fund’s Policy Development and Review Department and the chief emerging market economic strategist at Salomon Smith Barney.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts