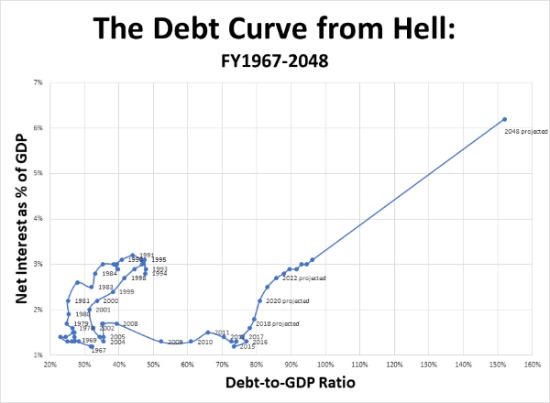

The debt curve from Hell is upon us

With the media lavishing much deserved attention on the U.S. economy’s renewed vitality, the Congressional Budget Office’s latest long-term budget projections will — despite repeated warnings — come as a rude awakening for most Americans. The fiscal outlook is dire.

As the Congressional Budget Office (CBO) cautioned:

“At 78 percent of gross domestic product (GDP), federal debt held by the public is now at its highest level since shortly after World War II. If current laws generally remain unchanged, the Congressional Budget Office projects, growing budget deficits would boost that debt sharply over the next 30 years; it would approach 100 percent of GDP by the end of the next decade and 152 percent by 2048.

“The prospect of a large and growing debt poses substantial risks for the nation and presents policymakers with significant challenges,” the CBO stated.

{mosads}But words alone cannot convey the extent to which the publicly-held federal debt has ballooned in recent years. Words also fail to capture the heavy fiscal and economic toll that the publicly-held federal debt promises to levy in the years ahead.

From 1967 to 2008, the federal debt-to-GDP ratio ranged from less than a quarter to just under half of GDP. Policy analysts projected a large and sustained increase in the debt relative to GDP, but lawmakers were comforted by the knowledge that the day of reckoning wouldn’t occur for years.

Then came the Great Recession. The recession brutalized the U.S. economy and years of debt were compressed into mere months. This raised the publicly-held federal debt to a level not seen since the late 1940s.

It is from this already elevated level that the debt is projected to explode, spiraling to unprecedented levels and, more importantly, feeding what could charitably be called “The debt curve from Hell.”

Source: Congressional Budget Office

One saving grace of the Great Recession was that the run-up in the publicly-held federal debt occurred just as interest rates collapsed. This allowed the federal government to finance its debt at little cost.

As recently as fiscal year 2016, for example, the federal government spent $240 billion on interest on the publicly-held federal debt. That’s literally $1 billion less than the federal government spent 20 years earlier to carry a debt only one-fourth as large.

The publicly-held debt has exploded, but we are only now beginning to pay the extra cost of carrying that debt. This year alone, net interest costs will total $316 billion — 32 percent more than just two years ago. And it only promises to worsen.

With interest rates starting to normalize, net interest costs are expected to grow at an average annual rate of 21.7 percent over the next three years and 7 percent a year on average for the subsequent seven years.

Within 10 years, annual net interest costs are expected to soar to $915 billion. The difference between what the federal government paid in interest last year versus what it will pay a decade from now is greater than Argentina’s total annual economic output.

This will place severe pressure on the federal budget. Rising net interest costs will consume roughly half or more of every new dollar of federal revenue in each of the next three years and more than 27 cents of every new dollar of federal revenue over the next 10 years.

Factor in the projected increase in federal outlays for health care and other mandatory spending programs and the federal budget gradually spirals out of control. Rising deficits grow the debt and the growth in the debt aggravates the deficit. It’s a vicious cycle.

This unwelcome development is emerging despite large projected increases in federal revenue. Under current law, revenue will jump from 16.6 percent of GDP this year to 18.5 percent by 2028 and 19.8 percent by 2048.

As House Ways and Means Chairman Kevin Brady (R-Texas) so aptly observed, “One thing has been clear for years: Washington does not have a revenue problem; it has a spending problem.”

Consequently, avoiding the debt curve from Hell will require policymakers to stabilize the federal debt-to-GDP ratio through a combination of deficit reduction and policies to accelerate long-term economic growth.

Unless taxpayers are willing to shoulder a substantially larger tax burden, most of the deficit reduction must come from restraining mandatory spending growth. Discretionary outlays are already slated under current law to fall sharply as a share of GDP.

By contrast, mandatory outlays are projected to grow by 2.5 percent of GDP over the decade. Spending restraint and deficit reduction will produce additional savings in the form of smaller interest payments. This will further reduce the deficit. A virtuous cycle!

Economic growth is the other key to avoiding the debt curve from Hell. Following a decade of stunted economic growth, the U.S. economy is responding positively to Congress’ and the Trump administration’s policy cocktail of regulatory relief and pro-growth tax reform.

Further progress will require new policies to encourage labor-force participation and to train and equip those new workers.

Workfare reform, a new emphasis on technical and vocational training and making the tax law’s expensing provisions permanent (and expanding them to cover structures) would help the U.S. reach its full economic potential.

America is on the verge of the debt curve from Hell. Don’t say you haven’t been warned.

James Carter served as the head of tax policy implementation on President Trump’s transition team. Previously, he was a deputy assistant secretary of the Treasury and deputy undersecretary of labor under President George W. Bush.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts