At 21 or 20 percent, new corporate tax rate will boost US economy

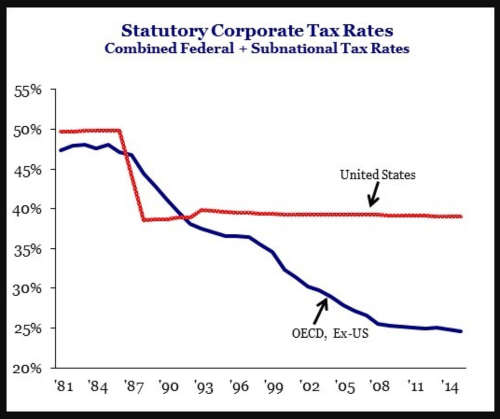

Since the 1990s, U.S. corporations have been subject to one of the highest statutory tax rates in the world. The high rate has caused them to rearrange their affairs to avoid investing, especially in lines of business subject to the full rate, and thereby reducing productivity and workers’ wages.

But now Republicans in Congress appear to have agreed on reducing the rate by 14 points, to 21 percent, plus the applicable state rate, bringing the total into line with the statutory rates elsewhere in the industrialized world.

President Trump had originally insisted on a federal corporate rate of no more than 20 percent, but Congress appears to have chosen 21 in order enhance the bill’s revenue outlook. It is worth assessing how much revenue was gained, and worker wages lost, by this deviation from the president’s plan.

Although I expect that the federal government will be getting less corporate tax revenue than it would without any tax reform, it is possible that the change from 20 to 21 percent by itself has little or no effect on revenue.

That one extra point may prevent the U.S. from undercutting a number of countries such as Spain, the Netherlands, Austria and Chile and thereby reduce the amount of business activity that relocates here from those nations.

So, as compared to the president’s plan, the IRS will be collecting an extra point on corporate income, but there will be less corporate income than there would have been.

The tax reform’s expensing provisions — generous deductions for new investment projects — also encourage business investment apart from the rate cut, and it has been argued that expensing provisions by themselves create a lot of the economic growth generated by the reform.

Thus, even if adding a point does little to enhance revenue, it may also do little to limit the wage gains that come with reforming corporate taxes.

It is important to remember that much business is not corporate business, but rather organized as partnerships, S-corporations, etc. Ideally these organizational decisions would be made for real business, rather than tax reasons.

{mosads}It remains to be seen how the new corporate rate meshes with the reform of taxation of non-corporate businesses, because it depends on how the IRS and tax accountants interpret the new rules.

But I expect that there are some non-corporate businesses whose rates would have been a couple of points higher than a 20-percent corporate rate (plus the relevant personal income and state corporate taxation), so that adding a point to the corporate rate mitigates some of the unintended consequences on that margin.

Finally, future Congresses may be willing to further change the rates, especially to the degree that the changes are small. Recall that the last big corporate rate cut in 1986 was followed by a one-point change during the Clinton administration.

For all of these reasons, the consequences of a one-point deviation from the president’s plan are small compared to the overall economic benefits from a long-overdue reform of the corporate tax.

Casey Mulligan is a professor of economics at the University of Chicago. His recent research has focused on non-pecuniary incentives to save and work and how the economy affects policy. His two recent books are, “The Redistribution Recession: How Labor Market Distortions Contracted the Economy,” and “Side Effects: The Economic Consequences of the Health Reform.”

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts