GOP tax plan the result of a runaway campaign finance system

Republican tax reform is either a profile in courage or a reflection of the need to change an out of control campaign finance system. A CNBC poll showed that Americans want Congress and the president to focus first on items other than tax reform.

Other polls indicate that most Americans are against cutting the corporate tax rate and a majority don’t believe corporations will put the tax savings toward job creation. So why has Congress made a tax bill with two-thirds of the proposed tax cuts going to corporations their priority? It is all about finances.

{mosads}What is uncertain is whether it is about the country’s finances or campaign donation finances. By process of elimination we can find the answer.

The primary argument for cutting corporate tax rates is that corporations will use tax savings to hire more people. This implies that a lack of capital is keeping corporations from hiring more people. Are corporations starved for capital?

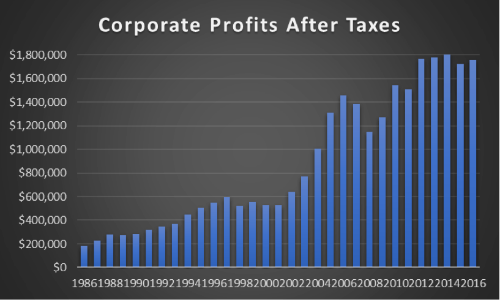

In 2016, corporate profits after taxes were near record levels at more than $1.7 trillion, nearly 10 times the 1986 level. For perspective, during this same period, inflation increased 2.2 times.

Source: Bureau of Economic Analysis

What about cash and liquid investments? While it varies from company to company, according to S&P Global Ratings, in 2016, the 2,000 non-financial corporations S&P tracked had corporate cash and liquid investments totaling $1.9 trillion — that’s a lot of capital. It doesn’t seem all corporations are hurting for cash.

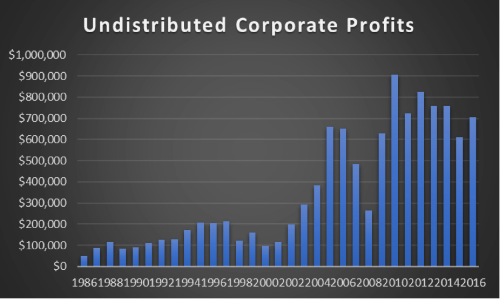

Another argument for reducing the statutory corporate tax rate is that it will increase business investment. This too implies that corporations don’t have enough capital. If that was the case, you’d expect corporations to retain less of their profits. Yet, since 1986, undistributed corporate profits have growth significantly, totaling more than $700 billion in 2016.

Source: Bureau of Economic Analysis

Profits are growing but corporations are retaining more of their after-tax profits. If corporations have near-record after-tax profits, yet are retaining more and more of those profits, the idea that even greater after-tax profits will increase business investment is illogical.

A third related argument for lowering the statutory corporate tax rate is that it will lead to increased wages. If companies have near-record profits and are retaining more and more of those profits, why will more after-tax profits suddenly lead to increased wages? That too is illogical.

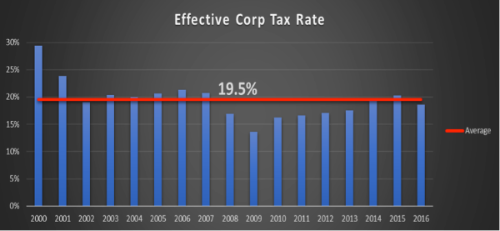

A fourth argument for lowering the corporate tax rate from 35 percent to 21 percent is that 35 percent is onerous. If corporations paid 35 percent, that might be an argument to consider, but they don’t. It might surprise some readers to learn that the actual average tax rate paid by corporations is already less than 20 percent.

The estimated average tax rate paid by corporations in 2016 was 18.6 percent. Corporations on average have been paying 19.5 percent in taxes since 2000. That eliminates that argument.

Solutionomics’ calculations using Bureau of Economic Analysis data

The only argument that could be made for lowering corporate tax rates is to lower the corporate tax rate for small businesses. They are the companies with more limited access to capital. Large companies with piles of cash have banks lined up down the street to lend them money.

It is the small business owner that needs more capital. Yet, currently proposed tax bills disproportionately favor large multinational corporations. How many small businesses will benefit from reducing the tax rate on foreign-earned profits to 12 percent or 5 percent? Not many.

If Congress really wanted to increase hiring, wages and business investment, they would make small businesses the priority. They would make corporate tax rates contingent on what percentage of each company’s employees were based in the U.S. This would benefit small businesses as they don’t have far flung employees across the globe.

They would make corporate tax rates contingent on each company’s percentage increase in jobs. It is easier for a small business to double its number of employees. These two simple solutions would focus on increasing after-tax capital available to small businesses, the businesses needing it most and the businesses that are the heart and soul of job creation.That shouldn’t take too much courage.

If Americans want Congress and the president to focus on other items first; the majority don’t want lower corporate tax rates; the majority don’t believe companies would use increased after-tax profits to increase hiring; and four of the primary arguments for corporate tax cuts don’t hold up when looking at the financial facts, then by process of elimination, that leaves an out-of-control campaign finance system.

It seems that rather than a profile in courage, some in Congress are focusing on their campaign finances as opposed to the finances of the country. Doubt this? Republicans have said as much. Consider these quotes:

“My donors are basically saying, ‘Get it done or don’t ever call me again,’” Rep. Chris Collins, (R-N.Y.) said.

“The financial contributions will stop,” Sen. Lindsey Graham (R-S.C.) said.

So much for courage. Maybe instead of a tax bill founded on false premises, someday Congress will have the courage to instead undertake meaningful campaign finance reform.

Chris Macke is the founder of Solutionomics, a think tank focused on developing solutions and recommendations for a more efficient, merit-based corporate tax code. He has advised the U.S. Federal Reserve by providing market updates and implications of monetary policy changes on asset valuations and market distortions, and he’s a contributor to the Fed Beige Book.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts