New Yorkers have a right to be salty over SALT deduction repeal

New York receives 81 cents for every dollar it pays in federal taxes. Contrast that with South Carolina, which receives $1.71 for every dollar it pays in federal taxes.

Yet, through its proposed repeal of state and local tax (SALT) deductions, the current Senate tax bill would have New Yorkers pay even more to the federal government. But this isn’t just a question of state equality, it’s a question of bad economics for the country.

{mosads}Would you invest in a company run by managers allowing its subsidiaries earning the least to use pricing discounts to steal customers from its subsidiaries earning the most? What if you found out that, worse still, the pricing discounts used to steal the customers were in effect subsidized by the subsidiaries earning the most for the company?

Well, that is what Congress is allowing to happen today. Low-SALT states like South Carolina are stealing higher-earning jobs from states like Washington using state tax breaks subsidized by high-SALT states like New York, and the current Senate tax bill would make it worse.

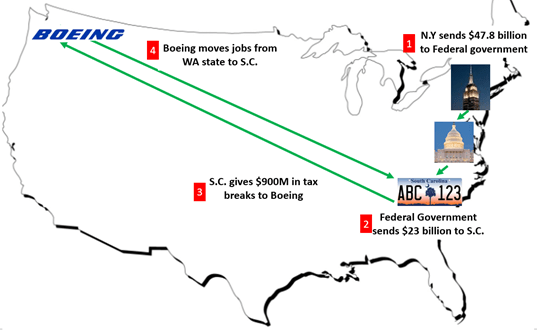

Consider the case of South Carolina, New York, Washington state and Boeing. As part of its effort to poach Boeing jobs from the state of Washington, South Carolina provided an estimated $900 million in corporate tax incentives, and that doesn’t include approximately $33 million in worker training to be provided by the state.

How could South Carolina afford that type of incentive? For every dollar paid in federal taxes, South Carolina received $1.71 in federal funds equating to $23 billion more than it paid into the system. Talk about a great return on “investment.”

Could South Carolina have afforded nearly $1 billion in tax breaks for Boeing without the $23 billion in federal subsidies? Conversely, New Yorkers paid nearly $48 billion more in federal taxes than they received in federal funds, in effect subsidizing the tax incentives South Carolina used to poach jobs from the state of Washington.

Besides the inequity among South Carolina and New York, what did the country get for this? The country got a nearly 33-percent reduction in worker pay.

When South Carolina, in effect, used federal tax dollars to poach Boeing jobs from the state of Washington, the country saw a nearly 33-percent — or more than $10-per-hour — reduction in wage levels. Boeing’s Washington-based jobs paid $32.05 an hour while the Boeing jobs in South Carolina paid $20.59 an hour.

Let me summarize this for you:

- New Yorkers sent nearly $48 billion more dollars to Washington, D.C. in 2015 than they received from D.C.

- South Carolinians receive $23 billion more from D.C. than they paid in federal taxes.

- South Carolina provided nearly $1 billion in incentives to poach Boeing jobs from the state of Washington.

- Boeing employee wages were reduced nearly 33 percent, or more than $10 per hour.

Source: Solutionomics

Would a CEO let its lower-earning divisions use funds from its higher-earning divisions to siphon off business from its higher-earning divisions? Of course not, but that is effectively what we are doing when low-SALT states poach jobs from higher-wage states, all in effect subsidized by high-SALT states.

Yet, the current Senate tax bill would exacerbate the problem by repealing SALT deductions. While Rep. Peter King (R-N.Y.) is justified in his anger, Americans should be equally concerned about the Senate’s proposal to exacerbate the problem further.

We need smart tax reform that will increase wages, not further subsidize low-SALT states poaching jobs from higher-paying states. China already does a good enough job of siphoning off our higher-paying jobs.

Chris Macke is the founder of Solutionomics, a think tank focused on developing solutions and recommendations for a more efficient, merit-based corporate tax code. He has advised the U.S. Federal Reserve by providing market updates and implications of monetary policy changes on asset valuations and market distortions, and he’s a contributor to the Fed Beige Book.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts