Congress can’t seem to solve its spending problem — we need a fiscal commission, now

The Congressional Budget Office (CBO) recently released its 10-year budget and economic projections, and the outlook appears dismal.

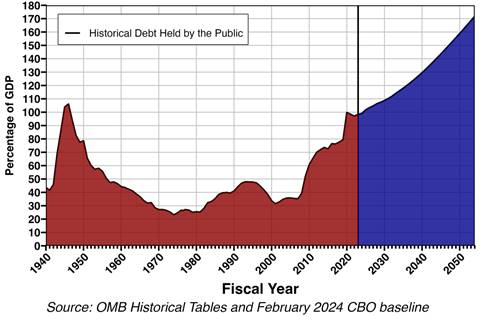

After years of warnings about the growing unsustainability of our debt, the CBO now projects that we are hitting a tipping point. Even using the most conservative measurement — $27 trillion— our debt will exceed the size of our entire economic output (GDP) next year, and will grow to over 170 percent of GDP in three decades. CBO also projects that annual deficits will surpass — and stay above — $2 trillion after 2031.

We are in dangerous, uncharted territory.

Figure 1. Historical Debt Held by the Public, as a Share of GDP

These unprecedented deficits are being driven by both increased spending and stagnant revenues as a percentage of GDP, though spending plays a much greater role. Revenue is set to fall by about 2.1 percentage points (as a share of GDP) over the 34-year window from 2000 to 2034. However, spending will increase by 6.5 percentage points, driven by healthcare and retirement benefits.

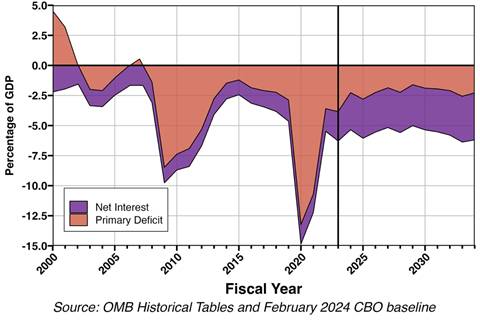

Medicare and Medicaid costs will more than double. Payments on interest will almost double. Even a surplus in the rest of the budget would be swamped by the large deficits in entitlement programs. With these trends in spending, net interest spending is set to overtake both defense and Medicare spending this year.

Table 1. Changes in Revenue and Spending, 2000–2034, as a Share of GDP

| 2000 | 2023 | 2034 (proj.) | Change (% GDP) 2000–2034 | |

| REVENUE | 20.0 | 16.5 | 17.9 | -2.1 |

| Individual Income Taxes | 9.9 | 8.1 | 9.5 | -0.4 |

| Payroll Taxes | 6.5 | 6.0 | 5.9 | -0.6 |

| Corporate Income Taxes | 2.0 | 1.6 | 1.3 | -0.7 |

| Other | 1.6 | 0.8 | 1.2 | -0.4 |

| SPENDING | 17.7 | 22.7 | 24.2 | +6.5 |

| Medicare and Medicaid | 3.1 | 5.4 | 6.4 | +3.3 |

| Social Security | 4.0 | 5.0 | 5.9 | +1.9 |

| Other Mandatory | 2.3 | 3.5 | 2.9 | +0.6 |

| Defense | 2.9 | 3.0 | 2.5 | -0.4 |

| Nondefense Discretionary | 3.2 | 3.4 | 2.6 | -0.6 |

| Net Interest | 2.2 | 2.4 | 3.9 | +1.7 |

| SURPLUS/DEFICIT | 2.3 | -6.2 | -6.3 | -8.6 |

| DEBT HELD BY PUBLIC | 33.7 | 97.3 | 116.0 | +82.3 |

| Source: OMB Historical Tables and February 2024 CBO baseline | ||||

Making these dire warnings even more troubling is the fact that the reality is almost certain to be worse than the CBO estimates.

CBO is required to base its projections on current law for the next decade. This means that the estimates described above assume the expiration in 2025 of popular provisions of the Tax Cuts and Jobs Act of 2017 and the Affordable Care Act premium subsidies, and the implementation of a 5.1 percent cap on discretionary spending in the Fiscal Responsibility Act of 2023. Politically, these current law tax hikes or spending constraints are likely non-starters. Considering these likely changes, annual deficits are likelier to be about $3.6 trillion by 2034.

So why does this matter? Unless the current trajectory is addressed, rising annual deficits and the unprecedented accumulation of debt will affect all of us through lower economic growth, benefit cuts under law to seniors, and a weakened military at a time when our national security is already under threat.

The credit rating agency Fitch downgraded the U.S.’s credit rating last year and another, Moody, lowered the credit outlook to negative. This was only the second time the U.S. has faced a downgrade, the first being in 2011 by the agency S&P. Further downgrades due to a dismal fiscal outlook would add fuel to the fire and prompt further interest expenditures. A corresponding decline in private and public investment in U.S. government bonds would lead to higher interest rates and the risk of the dollar no longer being the world’s reserve currency, endangering America’s economic and geopolitical power. The CBO projects that net interest will already exceed primary deficits in the next decade; this cannot continue.

Figure 2. Primary Deficits and Net Interest Expenditures as a Share of GDP

It is unthinkable that we would put this burden on future generations, and yet, without bold fiscal reforms, that is exactly what is happening. Only recommendations from a depoliticized fiscal commission, adopted by Congress, would calm these fears and prevent the U.S. from slipping into a vicious circle of higher debt and inflationary bursts.

These dire predictions happen to coincide with debate in Congress over this year’s annual spending, which is set to come to a head again by week’s end. The fiscal 2024 spending decisions are five months late and contentious, reflecting the partisan divide and razor-thin majorities in both Houses. The one thing all sides can agree on is that the current trajectory is unsustainable and dangerous, and that Congress, which has not completed its appropriations bills on time for more than 25 years, is not able to deal with the tough budget issues before us.

In order to address this ever-growing debt crisis, Congress should set up a fiscal commission, putting everything on the table and conducting an exhaustive review of federal spending. A commission consisting of elected members of Congress as well as budget experts, insulated from the political crossfire, can not only tackle the hard choices to put America on the path to fiscal solvency but also explain the high stakes and offer an honest assessment.

A commission’s exhaustive recommendations could be far-reaching. Looking back, the BRAC commissions saved billions of dollars, and the 1981 Greenspan Commission was instrumental in saving hundreds of billions as well as ensuring the solvency of Social Security for an additional 30 years. Even the failed 2010 Simpson-Bowles commission had a tremendous impact, with many of its proposals being enacted in subsequent years. That being said, a new fiscal commission must be set up to succeed; congressional approval and buy-in are a must, as is a lower qualified majority for a recommendation to be approved.

It is time for a much broader look at the fiscal crisis and to explain the consequences of an action to the American people. While recent legislation like the Fiscal Responsibility Act of 2023 attempted to reduce the deficit as much as $1.5 trillion in non-mandatory spending over the next decade, this is only a drop in the bucket, given the amount of increased debt projected over that same period. What’s more, Congress cannot seem to even agree to stick to those reductions.

I applaud Speaker Johnson, the House Budget Committee, and so many former Senate colleagues who, on a bipartisan basis, have supported establishing a fiscal commission. I understand that the path toward fiscal sustenance is an uphill trek for Congress. Yet the goal is not unattainable, and reaching it would only prove the naysayers wrong. I therefore urge Congress to establish a fiscal commission to put America’s fiscal house in order.

Rob Portman is a former Office of Management and Budget Director who represented Ohio in the Senate as a Republican from 2011 to 2023 and in the House from 1993 to 2005, serving on both the House and Senate Budget Committees. He is currently a fellow at American Enterprise Institute.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts