Biden bank rescue provokes GOP uproar

President Biden is facing strong pushback from Republicans challenging his claim that U.S. taxpayers won’t foot the bill for rescuing wealthy investors who deposited their money in Silicon Valley Bank, which federal regulators now control.

GOP senators argue the banks around the country that pay into the Federal Deposit Insurance Corporation (FDIC), which will cover depositors’ losses, are also U.S. taxpayers and that higher bank fees are likely to be passed down to consumers.

They also have questions about the creation of a new lending facility the Federal Reserve announced on Sunday to provide other banks with liquidity if depositors begin to demand their money back en masse as they did at Silicon Valley Bank.

The Fed’s new Bank Term Funding Program will be backed up by $25 billion the Treasury Department will make available from the Exchange Stabilization Fund, which Congress relied on to keep financial markets from freezing at the onset of the COVID-19 pandemic.

Sen. James Lankford (R-Okla.), who voiced his concerns during a briefing call that Treasury Department and FDIC officials held with GOP senators, said while President Biden claims no taxpayers will be affected, “they’re doing a special assessment on every bank and every bank is going to pass the cost on to every taxpayer.”

Lankford said Republican lawmakers “are trying to figure out why they didn’t have the auction” to sell Silicon Valley Bank to PNC Financial or another commercial bank to give a private sector competitor a chance to gain Silicon Valley’s book of business and make its depositors whole.

One Republican senator asked administration officials on the briefing call about a rumor that the administration blocked the merger between PNC and Silicon Valley Bank because of a general opposition to bank mergers.

GOP lawmakers are wondering why federal regulators felt the need to designate Signature Bank, which had $110 billion in assets, as a systemic risk along with Silicon Valley Bank, which had $209 billion in assets.

Sen. James Lankford (Peter Afriyie)

“They’re not handling it the way they would typically handle it so we’re trying to figure out over the weekend how they’re making policy. They’re setting precedent up without input and they’re setting precent that I think would be long-term damaging to banking,” Lankford said.

Lankford noted that Silicon Valley Bank had a lot of investment from China, raising concern that billions of dollars in FDIC money could go toward making Chinese depositors whole.

“We don’t know for instance if foreign account holders are going to be made whole the same as domestic” depositors, he said. “SVB obviously has a lot of investment from China. Are all those account holders going to be made whole by Oklahomans who are in community banks that are going to have to pay a special assessment to cover Chinese deposits.”

Sen. Mike Crapo (R-Idaho), a senior member of the Senate Banking Committee, who participated on the Monday call, said the prospect of Chinese depositors being made whole “is an issue to me.”

Crapo said lawmakers haven’t gotten a satisfactory explanation from the Treasury Department and FDIC about the failure to sell Silicon Valley Bank to a private sector buyer.

“We haven’t got much information except that they haven’t been able to find a buyer. I know there’s a lot of information running around out there about why not and who might have been and what’s going on now but we haven’t been given any of that information,” he said.

Sen. Mike Crapo (Greg Nash)

Crapo said hearings “would be very helpful” and that officials from Treasury, the Federal Reserve and the FDIC should testify before Congress.

Sen. Rick Scott (R-Fla.) is calling the administration’s rescue of Silicon Valley Bank, Signature Bank and other financial institutions facing liquidity problems “a Wall Street bailout” and pointing the finger at Federal Reserve Board Chairman Jerome Powell.

Sen. Josh Hawley (R-Mo.) announced legislation Monday to protect consumers and community banks from the special assessment fees the Biden administration will impose on financial institutions to cover the losses of Silicon Valley Bank’s depositors.

“What’s basically happened with these ‘special assessments’ to cover SVB is the Biden Administration has found a way to make taxpayers vote for a bailout without taking a vote on it,” he tweeted.

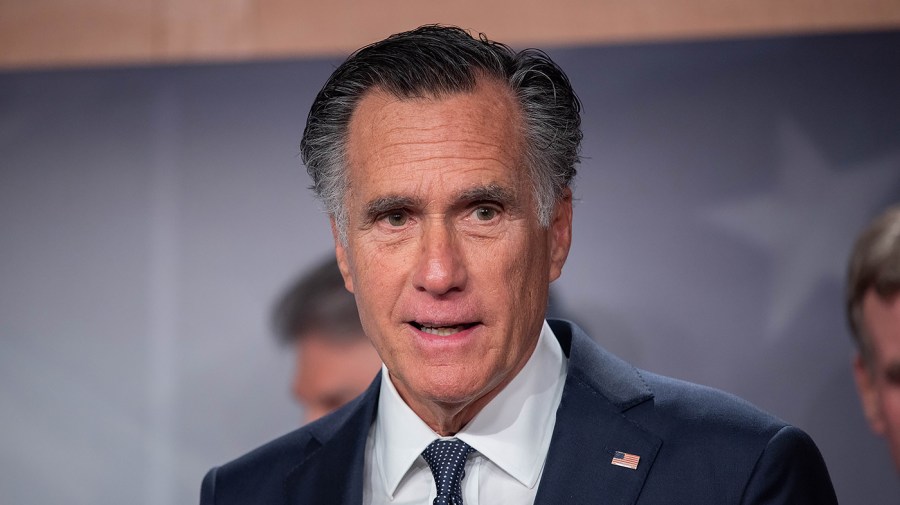

Republican views on the rescue are mixed, with some Republicans, including Sen. Mitt Romney (R-Utah) and House Financial Services Committee Chairman Patrick McHenry (R-N.C.) respectively praising the administration’s moves as the “right decision” and “appropriate.”

“They’re trying to send the message that your bank accounts are safe in America so there’s no need to move money from one bank to another based on some social media feed … that’s the clear message they’re sending and I think that’s the appropriate message,” McHenry said in a CNBC interview Tuesday.

But other Republicans are hammering the Biden administration for trying to frame its interventions as something other than a bailout.

Sen. Ron Johnson (R-Wis.) said Biden’s rescue will encourage risky behavior by depositors in the future, warning of a “moral hazard.”

“I’m sympathetic that we don’t want to cause contagion but the Fed could have done a bunch of things to prevent a contagion. You could go in and offer a lending facility for depositors at a certain percentage of their deposits,” he said.

Some Republicans, including Sen. Mitt Romney have praised Biden’s decision to rescue Silicon Valley Bank. (Annabelle Gordon)

He said the depositors should be forced to take a “haircut.”

“At some point in time you have to put depositors on notice,” he said, adding that “every American” is going to have to absorb higher costs.

“These people are sloppy because they just expect a bailout,” he said.

Rep. Matt Gaetz (R-Fla.), a high-profile House conservative, tweeted “I will NOT support a taxpayer bailout of Silicon Valley Bank.”

In another tweet, he called Silicon Valley Bank “the Democrats’ ATM” and said “maybe this why they got a corrupt bailout without so much a VOTE by the elected representatives of the people. Sickening!”

The bank rescue is getting attention in the GOP presidential primary.

“Joe Biden is pretending this isn’t a bailout. It is,” said Republican presidential candidate Nikki Haley on Monday. “Now depositors at healthy banks are forced to subsidize Silicon Valley Bank’s mismanagement. When the Deposit Insurance Fund runs dry, all bank customers are on the hook. That’s a public bailout.”

Crapo, however, defended the Biden administration’s decision to take action without getting express support from Congress, which could have taken days or longer.

“They had to move fast and by the way, we were consulted, I was consulted. So there was consultation, but I still think there needs to be more,” he said.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts