Supreme Court to consider ‘quadrillion-dollar question’ in major tax case

The Supreme Court will hear oral arguments in early December on a case that has the potential to broadly reshape the U.S. tax code and cost the government hundreds of billions of dollars in revenue.

At issue in Moore v. United States is the question of whether the federal government can tax certain types of “unrealized” gains, which are property like stocks or bonds that people own but from which they haven’t directly recouped the value, so they don’t have direct access to the money that the property is worth.

Large portions of the U.S. tax code require that income be “realized” before it can be taxed, but critics say it’s an inherently wishy-washy concept that courts have just been ignoring for years due to administrative impracticalities.

BestReviews is reader-supported and may earn an affiliate commission.

Best Prime Day 2024 Deals

Even if the court limits the scope of its decision to the specific tax referenced in the case, known as the mandatory repatriation tax, a ruling in favor of the plaintiffs could cost $340 billion over the next decade, according to the Justice Department.

Tax issue: $1 trillion in unpaid corporate taxes sparks UN tussle

For comparison, that would cancel out all the extra revenue generated by the $80 billion IRS funding boost and then add $140 billion to the national deficit, which now stands between $26 and $33 trillion, according to various measurements.

But experts say the cost could be much higher than that if the court broadens out its definition of what counts as realization, pushing heaps of taxable income out of the government’s reach.

The decision could have implications for everything from potential wealth taxes, like the one the Biden administration proposed for billionaires in 2022, to large swaths of the international tax regime.

The U.S. solicitor general herself is scheduled to argue the case before the justices, underscoring how the Biden administration views its importance.

Top Stories from The Hill

- Trump lawyers seek evidence to relitigate election fraud claims in Jan. 6 case

- House GOP lawmakers who flouted chamber’s mask rule take legal fight to Supreme Court

- Santos says he’ll stand for expulsion vote

- GOP faces ominous signs in effort to avoid January shutdown

“It’s the million-dollar question, just with a few more zeros: the quadrillion-dollar question,” Harvard University tax law professor Thomas Brennan told The Hill.

“On one extreme, if the Supreme Court decides that a realization requirement is present in the 16th Amendment … then there are a number of code sections that arguably would be invalid or have to be reworked,” he said.

These sections could involve partnership tax rules, rules on the taxation of debt and commodities, taxes on futures contracts and the international tax rules that string these areas together between countries.

“On the other extreme, even if the Supreme Court finds in favor of the taxpayers, they could do so in a narrow way that’s limited to the particular situation at hand, or in a way that … forecloses the possibility of Congress enacting wealth taxes but that doesn’t disturb much of existing tax law,” Brennan said.

What is the Moore tax case?

The dispute arose from businesspeople Charles and Kathleen Moore’s investment in an Indian company that sells farm equipment.

Republicans’ 2017 tax bill imposed a one-time tax on Americans who owned shares in foreign corporations, even if the corporation hadn’t distributed any earnings to the taxpayer.

Avoiding taxes gets new scrutiny: IRS eyes partnerships in tax evasion crackdown

The Moores filed their lawsuit after paying a roughly $15,000 tax bill, court filings show.

Practical financial workarounds to realization

Whatever the decision of the court, which is expected before June of next year, there are in practice numerous, well-established workarounds for people who own a lot of “unrealized” property to access it before technically receiving it and having to pay taxes on it.

One famous strategy, known as “Buy, Borrow, Die,” involves using large, diversified stock portfolios as collateral for relatively low-interest loans.

Rather than selling the holdings and “realizing” the taxable income, wealthy taxpayers use them as collateral to take out low-interest loans. Since debt isn’t taxable, they can skip paying tax on the holdings.

As long as the portfolio appreciates faster than the rate of interest on the loan, payments can be made and the line of credit remains viable.

On the horizon: IRS establishes new pass-through division to tax high earners

A law allowing a “step up in basis,” which means that inheritors of assets get to claim their present-worth value as opposed to what they were worth when they were originally bought, permits this scheme to continue through generations.

That’s compared to taxes on workers’ wages and salaries, which are “realized” immediately upon being sent out and taxed before they even reach their recipients.

Conservative groups champing at the bit while critics cry foul

Conservative financial and economic groups have been rooting for a resounding endorsement of the realization requirement for tax purposes from the current court, which brushed aside decades of precedent in overturning the seminal abortion case Roe v. Wade last year.

“Realization has been the defining event that turns something from an asset holding value to income subject to federal tax under the Sixteenth Amendment,” lawyers for the Chamber of Commerce, the biggest business lobby in the U.S., exhorted the court in an amicus brief, filed in March.

“The framers [of the Constitution] intentionally created a system that makes it difficult to pass destructive taxes such as the [mandatory repatriation tax] or a wealth tax,” the Philanthropy Roundtable wrote in their own brief.

Critics of a blanket constitutional requirement for realization say the idea is trumped up, and it’s really just about the timing of when an asset is allowed to be taxed for accounting purposes.

They point to a 1940 decision in Helvering v. Horst finding that “the rule that income is not taxable until realized has never been taken to mean that the taxpayer … can escape taxation because he has not himself received payment of it from his obligor.”

This is because the taxpayer “has fully enjoyed the benefit of the economic gain represented by his right to receive income,” the court found. As such, the requirement was considered to be “founded on administrative convenience” and “not one of exemption from taxation.”

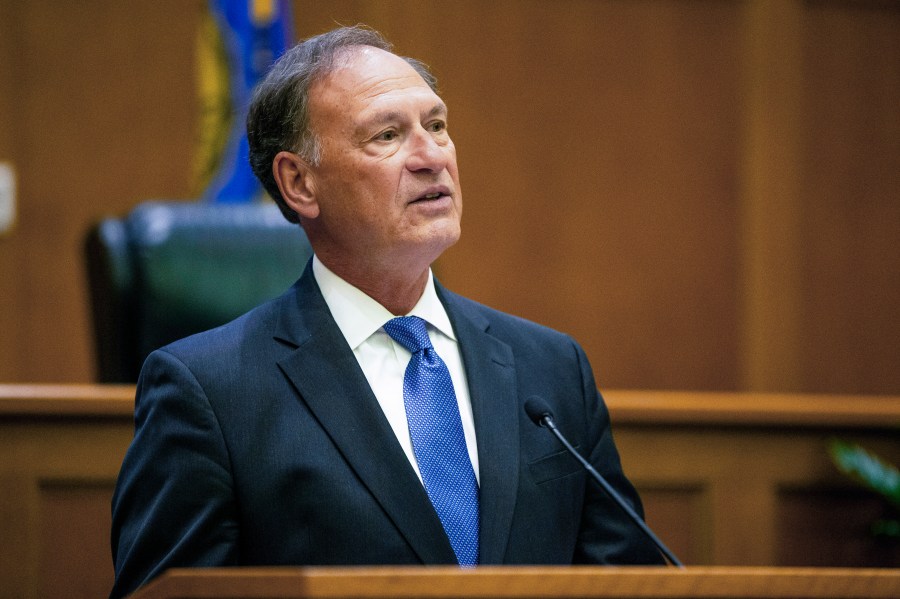

Calls for Alito to recuse have surfaced

Democrats have demanded that Justice Samuel Alito, one of the court’s leading conservatives, be recused from the case over his ties to one of the lawyers advocating for a realization requirement.

Alito participated in two interviews with the lawyer, David Rivkin Jr., that were published in The Wall Street Journal’s opinion section.

In a rare public response, Alito noted other justices who had interviewed with lawyers practicing before the court.

“There is no valid reason for my recusal in this case,” Alito said.

Tax lawyers worry the rules of the game are about to change

Tax lawyers are concerned that their jobs could change significantly due to the scope of the ruling.

“If [the court makes] a specific realization requirement, then it could have an impact on many other provisions of the Internal Revenue Code, because there are provisions currently … that arguably diverge from the realization rule,” Lawrence Hill, a partner at the Steptoe & Johnson law firm, told The Hill.

He described these divergences as “very significant,” saying the rules pertaining to taxation of partnerships, S corporations, grantor trusts, controlled foreign corporations and original issue discounts could be affected, in addition to entire accounting norms pertaining to tax accrual and adjusting valuations to a going market rate.

“That is the concern of the tax bar,” he said.

SCOTUS adopts code of ethics after scrutiny: Dems say it’s not enough

Kyle Pomerleau, a senior fellow at the American Enterprise Institute who filed an amicus brief supporting the government, said a broad ruling in favor of the Moores could lead others to file a deluge of lawsuits challenging those other portions of the tax code.

“A cloud is going to be cast over the U.S. economy, as there’s all this uncertainty about what the tax code is going to look like in five, 10, 15 years from now.”

Pomerleau instead suggested a narrower way for the Supreme Court to resolve the case that wouldn’t reopen the question of whether income must be realized for the federal government to tax it.

“Because this is a tax on business profits and a tax on the use of a certain type of foreign business entity, and because it’s a tax on foreign activity, not domestic activity, it falls under the umbrella of an indirect tax,” said Pomerleau.

“And indirect taxes don’t have the same limitation that direct taxes have under the Constitution, you don’t have to apportion them,” he continued. “Therefore, all of the Moores’ arguments kind of fall away.”

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts