Tax filers can keep more money in 2023 as IRS shifts brackets

The IRS on Tuesday announced rule adjustments to account for inflation for the 2023 tax year, including shifts for tax brackets and the standard deduction.

The IRS releases inflation adjustments annually, but this year’s announcement comes amid heightened economic concerns about high inflation and a potential recession.

The adjustments apply to the 2023 tax year, for which tax returns will generally be filed in 2024. They’re aimed at warding off “bracket creep,” when salary increases aimed at accounting for a higher cost of living end up pushing taxpayers into higher tax brackets.

The standard deduction will increase by $1,800 for married couples filing jointly, by $1,400 for heads of households and by $900 for single taxpayers and married taxpayers filing separately.

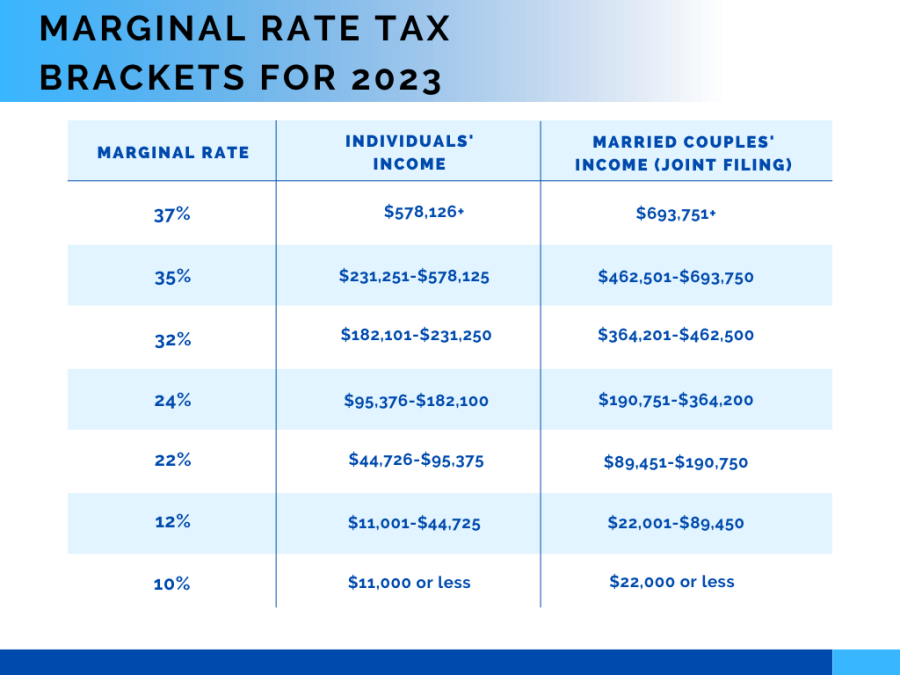

The income thresholds for tax brackets are among the provision changes “of greatest interest to most taxpayers,” according to the IRS. The tax rates themselves are unchanged from last year, ranging from 10 percent to 37 percent, but the income cutoffs have shifted.

The top rate of 37 percent applies to individual single taxpayers with income over $578,125 and married couples filing jointly with income over $693,750 — figures up from last year’s $539,900 and $647,850, respectively.

The lowest rate of 10 percent applies to single taxpayers with income $11,000 or less and married couples filing jointly with income $22,000 or less — up from last year’s $10,275 and $20,550, respectively.

A single taxpayer making $90,000 in the 2022 tax year would face a top tax rate of 24 percent, while the same income in the 2023 year will face a top rate of 22 percent.

Other announced IRS changes also affect the earned income tax credit, estate taxes and flexible spending accounts, among other provisions.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts