As Biden scrambles to reassure Black, Latino voters, some ask if the wealth gap can be fixed

The Biden administration is touting economic programs geared toward minority-owned businesses as Black and Hispanic voters show increasing disaffection toward Democrats following a year of higher consumer prices and soaring rents.

Recent polling indicates that Black, Hispanic and voters of other backgrounds may be turning away from President Biden.

A New York Times/Siena Poll released earlier this month found that 22 percent of Black voters in six key battleground states would choose former President Trump in next year’s election over Biden.

While that number still favors Biden in absolute terms, it’s a huge increase for Republicans over the historical baseline.

Trump won only 12 percent of the vote from Black Americans in 2020 and just 8 percent in 2016, according to the Roper Center for Public Opinion Research at Cornell University, citing exit polling data from CNN and CBS News.

The Times/Siena poll had 42 percent of Hispanic voters in swing states leaning toward Trump and 50 percent leaning toward Biden. The 2020 breakdown for Hispanic voters, according to the Roper Center, was 65 percent for Biden and 32 percent for Trump.

Fifty-one percent of voters from other nonwhite racial backgrounds now favor Trump, while just 39 percent favor Biden, the poll found.

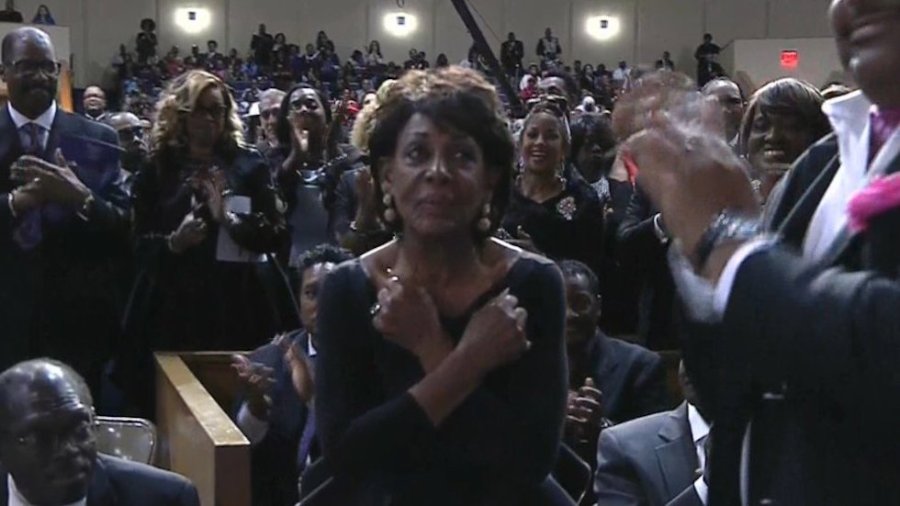

Speaking at the Congressional Black Caucus legislative forum in Washington in September, former U.S. Senate candidate for Alabama and nonprofit executive Brandaun Dean asked a panel of wealthy business people led by Rep. Maxine Waters (D-Calif.) whether the very concept of Black capitalism was a myth.

“Do you believe that Black wealth has a sympathetic effect in Black communities, Black networks and in Black spaces? And is Black capitalism as much a myth as it would seem to be to those who have inherited their power?” he said, addressing a crowd of hundreds gathered in the Walter E. Washington Convention Center.

Funding is being pushed by the Biden administration

Now, new moves to fund businesses and entrepreneurs in communities of color are gaining momentum.

Community development lending programs, small business grants, initiatives on minority depository institutions (MDIs), and lines of credit for “inclusive entrepreneurship” are all getting the hard sell from the Treasury Department as support for Democrats among minority voting blocs shows signs of faltering.

Last month, the administration announced a $3 billion commitment from a group of companies and philanthropies for money lending institutions “working to make historic investments in underserved communities.”

“The new private sector commitments announced today will maximize the Biden-Harris Administration’s investments in expanding access to capital in low-income, rural, and other underserved communities, which increase long-term productivity and economic growth,” Treasury Secretary Janet Yellen said in a statement.

The Treasury has also been publicizing federal grants worth $75 million for legal, accounting and financial advisory services for small businesses, as well as private credit lines worth $80 million for entrepreneurs of color.

“Entrepreneurs of color represent the fastest growing segment of the small business market, yet they have the least access to capital, are more likely to be denied credit, are more likely to pay high interest rates, and are less likely to apply for loans out of fear of being denied,” reads a write-up of one of the programs from Hyphen, a public-private facilitator set up to leverage money apportioned by several key pieces of Biden administration legislation focused on refurbishing the economy.

An October report from the Treasury analyzing foreclosure rates on homes and credit delinquency among Black and Hispanic Americans, as well as other economic factors, declared that the recovery from the coronavirus pandemic was “the most equitable in recent history.”

But doubts about an equitable and benevolent role for the government in supporting the private sector within marginalized communities are still firmly held by many entrepreneurs.

“[While] the government can inspire and create policies that make the game more fair, the reality is that the government can’t close the racial wealth gap by itself,” Cedric Nash, an author, real estate investor and founder of the Black Wealth Summit, told The Hill in an interview this month.

Public access to private capital makes a difference for minority business owners

Small business owners from nonwhite backgrounds say the kinds of investment programs being pushed by the Biden Treasury make a difference, because requirements for capital from private lenders can be too demanding.

“Early on, it was really hard,” Trent Griffin-Braaf, founder of the New York state-based transportation company Tech Valley Hospitality Shuttle, told The Hill.

Griffin-Braaf received funding from Pursuit, a Community Development Financial Institution (CDFI) certified by the U.S. Treasury.

“Going to the banks, I had a business plan, I had decent credit, but I still couldn’t get anywhere, so I just self-funded it. It was at least over a year before I was able to get a line of credit from a bank. A year after that, I was able to get a micro-loan from our chamber [of commerce],” he said, adding that he had a better experience with a CDFI than with banks.

“The Pursuit loan came for about $50,000 just weeks before Covid, and that money really just helped us get through the first months of the pandemic operationally,” he said. “Getting it felt like the world in the moment.”

Entrepreneur Jamahl Grace, who runs a small candle-making company based in Loudoun County, Va., told The Hill that even the U.S. Small Business Administration (SBA) — a government agency designed to support small businesses and help early-stage entrepreneurs — has some serious barriers to entry when it comes to securing financing.

“We looked into the SBA for a business loan, but we were just too young a business. We didn’t meet the criteria of how established you had to be. That created some barriers for us,” he said in an interview. “They said we needed to be in business for a certain number of years in order to qualify, and that made it very challenging.”

Economy still a hurdle for current administration

Biden’s handling of the economy has also been a weak spot in approval polls for months, as inflation rose last year to a 40-year high before subsiding gradually this year.

The consumer price index (CPI) eased further Tuesday to a 3.2-percent annual increase, with 70 percent of price increases — not counting food and energy — now concentrated in housing costs, according to the Labor Department.

August polling from Gallup found that while 42 percent of Americans approved of the job Biden was doing overall, just 37 percent signed off on his handling of the economy. An AP-NORC poll put that number even lower, at 36 percent, in August.

A report from Arizona State University in September found that value created in the U.S. economy by the Latino workforce totaled $3.2 trillion in 2021, up from $2.8 trillion in 2020, and is growing “two and a half times faster than the non-Latino equivalent.”

Skepticism about government support for the economy

Wariness about how effective the Biden administration can actually be in shoring up economically distressed segments of the population is also a common theme in communities of color.

“Whenever we leave it to the government to fix things, they never seem to really fix it. Because we have a system that’s designed for bipartisanship, I don’t think we’ll ever get a fair chance in that system,” Nash, the Black Wealth Summit founder, told The Hill, endorsing the role that financial assets can play in achieving financial independence and self-sufficiency.

“It’s really about the execution of taking the income that we make and the capital that we have available to us and converting that into assets that appreciate and do the work of generating income for us,” Nash said.

Other voices in the Black community take an even more skeptical view, not only toward the government but toward traditional conceptions of private enterprise within the public sphere, as well.

Atonn Muhammad, entertainment executive and CEO of the Real Hip Hop Network, addressing the panel at the Congressional Black Caucus legislative forum in September, asked whether the idea of Black wealth creation in America wasn’t better situated within the framework of a sovereign wealth fund, akin to those of several Gulf Arab nations.

“Why don’t we all combine forces? You’ve got the Robert Smiths of the world,” he said, referring to the prominent African American billionaire who sat on the panel.

“You’ve got the Jay Z’s and the Beyoncés, and when you look at the model of places like the United Arab Emirates, which have started sovereign wealth funds, in 20 years they’ve gone from a desert to an oasis of capitalism,” he said.

Earlier this year, the IRS confirmed a study out of Stanford University that found that Black taxpayers were three to five times more likely to be audited than other racial groups, likely a consequence of enforcement protocols associated with the earned income tax credit.

This story was updated at 2:13 p.m. on Nov. 28.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts