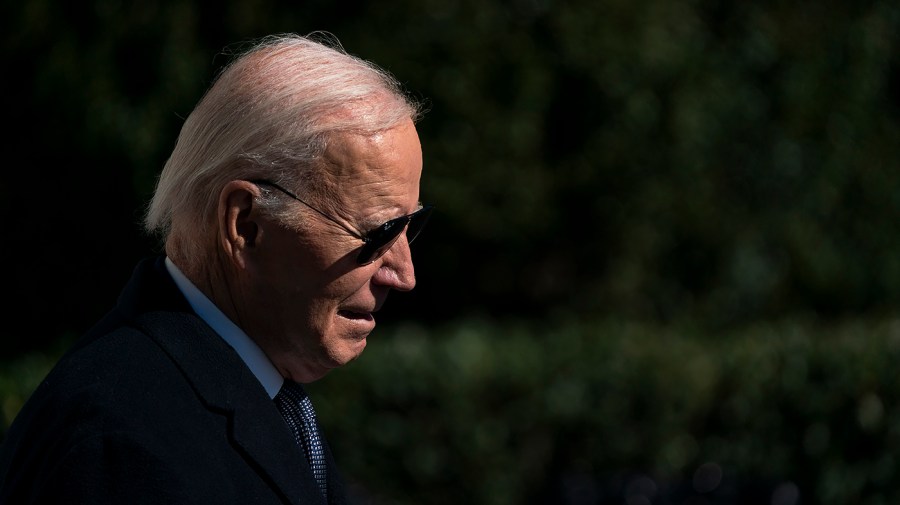

Job market slowdown looms over Biden reelection bid

President Biden and Democrats are in economic purgatory with less than a year until the pivotal 2024 election.

The U.S. economy is slowing down after years of rapid post-pandemic expansion, taking steam out of inflation on the way down. But the slow march toward an even-keeled economy is doing few political favors for Biden and his party.

Biden’s approval ratings have fallen to record lows as Americans feel the pinch of high interest rates and plateauing inflation.

While declines in job gains and wage growth may help the inflation fight, they also leave the administration with dwindling ways to sell Americans on its handling of the economy.

Julia Pollak, chief economist at ZipRecruiter, said the job market slowdown “partly explains why job seekers and new hires are feeling more stressed out than they have in over a year.”

“Rising financial strain, paired with declining worker leverage, are taking their toll. The decline in real disposable income last month suggests that consumer spending could cool further in the coming months, putting yet more downward pressure on the labor market.”

Record job gains but record-low approval

Biden and Democratic lawmakers have struggled to turn record-shattering job growth into positive polling on the economy.

The U.S. has added roughly 14 million jobs since Biden took office in January 2021 — far more than any of his predecessors. Millions of those jobs were simply products of a recovery already in motion before Biden’s election, but the president has still made the speed of the comeback a centerpiece of his reelection campaign.

“Today’s report shows that Bidenomics is growing the economy from the middle out and bottom up—not the top down,” the White House said in a Friday statement.

Biden and Democrats are eager to claim credit for the resilience of the U.S. labor market, which many economists predicted would be losing jobs by now.

With 150,000 jobs added last month and a jobless rate of 3.9 percent, experts say the U.S. is still adding far more than enough jobs to keep the economy out of recession.

“The economy needs to add only 75,000 jobs a month—compared with 200,000 a decade ago—to stabilize employment given demographic changes,” wrote Joseph Brusuelas, chief U.S. economist at audit and tax firm RSM, in a Friday analysis.

He added that the October jobs figures are “consistent with full employment” and “to be celebrated,” particularly after years of high inflation.

Biden’s support, however, has not been as sturdy.

Just 37 percent of Americans approve of Biden’s job as president, according to a Gallup poll released last week, in line with the lowest mark of his presidency. Biden’s support among Democrats also plunged 11 percentage points to a new record low of 75 percent.

The president’s approval among independents fell 4 percentage points to 35 percent, and just 5 percent of Republicans approve of Biden.

Recent polls of Biden’s handling of the economy and consumer sentiment have also fallen sharply, largely in step with an increase in interest rates and credit card balances.

Inflation, rate hikes remain supreme

Biden and top Democrats have largely blamed the media and Republicans for driving Americans’ dismal views on the economy.

In a remarks last month after a stunning September jobs gain, Biden ribbed reporters — ”not the happiest people in the world,” he said — for hyperfixating on inflation and recession fears.

“I think the people … who got jobs feel better about the economy,” Biden said in October.

Millions of Americans who lost jobs during the recession gained them back under Biden, and far faster than many economists expected. Intense demand for workers also helped tens of millions of Americans secure higher wages and new jobs with better pay, flexibility and career opportunities.

Callie Cox, U.S. investment analyst at eToro, also cited the record number of strike as a sign of “the power that employees have at this moment.”

After striking since Sept. 14, the United Autoworkers (UAW) union reached tenative deals this week with Ford, General Motors (GM) and Stellantis on new contracts that would boost worker pay by 25 percent.

The UAW also won back key concessions, including cost-of-living adjustments and more rapid progressions to top wage rates, given up after the Great Recession.

“We’re in the middle of an empowering movement in the job market that’s been a long time coming, and it’s just another reminder of how solid the economy is (even though it may not show through in economic data),” Cox wrote.

But while the job market is slowing toward its pre-pandemic strength, Americans are still grapping with both inflation and interest rates at their highest levels in decades.

Annual inflation peaked at 9.1 percent in June 2022, according to the consumer price index (CPI), before landing at 3.7 percent in September.

The slowdown in the job market may also be falling hardest on Americans least able to handle a setback, according to Nick Bunker, economic research chief at Indeed.

“The rise in unemployment is concentrated among workers who recently lost their jobs and the job finding rate of unemployed workers ticked down,” Bunker explained.

“Perhaps this rise is just a sign that the extraordinarily tight labor market of recent years is loosening. But continued upward momentum would be troubling.”

‘The Fed holds the keys’

Surging inflation pushed the Federal Reserve into the fastest interest-rate tightening cycle in its history, boosting borrowing costs to the highest level since the 2007-08 recession.

The Fed held off on boosting interest rates Wednesday for the second consecutive meeting, citing the toll of higher rates on businesses and consumers. Experts doubt the bank will raise borrowing costs again after the soft October jobs report.

“The good news is that this slowdown is not due to economic fundamentals, but rather due to careful orchestration by the Fed. If it turns out that the Fed and bond markets have gone too far, the Fed holds the keys to turning that around,” Pollak said.

Pollak said businesses “have many vacancies, they want to hire, and they want to expand. But high interest rates are holding them back. If rates start coming down next year, expect that pent-up demand for labor, transportation, building materials and a host of other inputs to be unleashed again.”

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts