Border tax would harm consumers, importers

The current corporate tax system is indefensible. Multinationals often pay only a small fraction of the tax paid by domestic corporations, and the current tax code gives companies an incentive to relocate jobs and headquarters overseas. For the sake of a healthier U.S. economy, these practices must end.

House Republicans have proposed a new corporate tax plan that breaks with over 80 years of U.S. policy by allocating profits to the place of consumption. They recognize tax avoidance is encouraged if corporations can choose where to allocate profits.

{mosads}A destination-based corporate tax would end the current problem of tax avoidance enabled by poorly defined profit residency.

The problem in the plan lies with an additional, ill-advised proposal by House Republicans — a border adjustment on taxes. Border adjustments would prohibit a deduction for imports.

While the resulting revenue could help reduce the overall U.S. corporate tax rate to 20 percent, it would unfairly burden companies that shoulder the restructured tax liability.

Import-dependent companies could owe a tax bill far larger than their profit. Clearly, this would be distortive, destructive, and unfair. Moreover, the cost of many products could drastically increase, unnecessarily penalizing consumers.

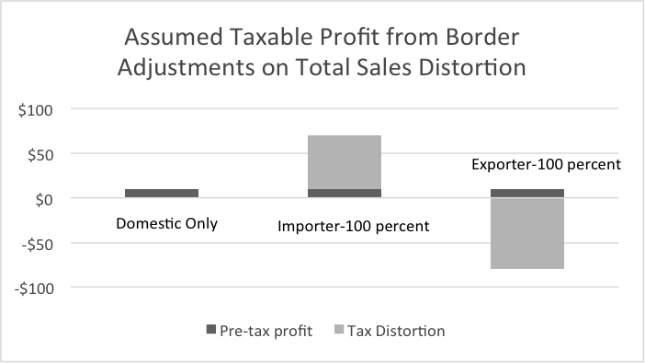

Under the proposed Republican plan, importing or exporting would greatly impact how sales are subject to U.S. tax. For example, when a company sells $100 in goods with a $60 cost, plus $30 in sales and administrative expenses, the profit currently subject to tax is $10.

At a 20 percent tax rate, after-tax profit would be $8, but border adjustments would radically distort this calculation.

Under the proposed plan, a company with 100 percent imports would now have $70 ($60 in costs, $10 in profits) subject to tax, instead of $10, because it would not be permitted to deduct the $60 cost of the goods it sells.

That retailer would then be required to pay $14 in tax on a $10 profit! To avoid bankruptcy, the company would need to increase consumer prices to compensate for the additional tax costs.

In contrast, an exporter would show a pretax loss of 90 percent because the sales would be ignored and only the $90 of expenses would remain.

These kinds of border adjustments would create distortions that give exporters a huge boost and fatally penalize importers. Domestic companies might export enough of their product, or a commodity like coal, to remove their tax liability. Exchange-rate adjustments are not likely to change the outcome.

Besides, business leaders cannot rely on correction via a dollar revaluation because contracts with manufacturers are set up months, or years, in advance.

The Republicans’ tax proposal to disallow interest deductions would create a stronger economy while bringing in additional revenue that could allow them to achieve most of their goals.

However, there is a preferable alternative — a standard, destination-based corporate tax that would treat all companies the same and generate the same taxable income from identical situations for all companies.

For instance, if a company had 40 percent of its sales in the U.S., then 40 percent of its profits would be considered made in the U.S. With no overall tax rate changes, this could increase U.S. tax revenue by approximately $550 billion over 10 years, with the added benefit of removing incentives to move businesses and jobs overseas.

A revised proposal would not involve the drastic and ill-advised cash flow distortions. Instead, it would target lower rates to small and medium-sized companies, rather than massive corporations that need them far less. In addition, multinationals would still get the territorial system they crave.

House Republicans could achieve their goals using a standard, destination-based corporate tax approach, known as sales factor apportionment (SFA), modified to disallow most interest deductions.

SFA would tax profits based on all sales within the U.S. and, when combined with consolidated reporting, distortions would no longer be a factor. The SFA approach modified to remove the interest deduction could provide virtually all the benefits Republicans are looking for without creating disastrous new problems.

While they’re unlikely to achieve an overall tax rate as low as 20 percent, reducing the corporate tax rate to 20 percent on the first few million in pretax profits would help the smaller domestic businesses that have long been a concern of Speaker of the House Paul Ryan (R-Wis.).

A destination-based corporate tax with SFA would tax many companies that now avoid paying their fair share. Such an approach without border adjustment would be the best approach to U.S. corporate tax reform.

Bill Parks is the founder of NRS, an outdoors company specializing in kayaking and rafting gear, boating equipment and river supplies. Parks holds a Ph.D. in finance and economics from Michigan State College (now Michigan State University).

The views expressed by contributors are their own and not the views of The Hill.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Regular the hill posts